IndiaMart is the largest online B2B marketplace for business products and services with approximately 60% market share of the online B2B classifieds space in India.

IndiaMart works on a negative working capital model via subscriptions i.e. they charge the customers before availing the service similar to Netflix, Tinder and Amazon Prime.

IndiaMart is one of the oldest internet businesses with its inception in 1996 and has been profitable since inception and was one of the few businesses which survived and thrived when the tech-bubble burst in 2000. IndiaMart has successfully pivoted the business model in the face of disruptions, once after 9/11 when their major market was exports to USA and their focus was primarily was travel industry during that time and in 2006-07 when real estate and employee costs rose dramatically which resulted in the company venture into raising of money and changing the business model from a classifieds business to the current B2B subscriptions platform.

Understanding the B2B space in India -

In India B2B space can be majorly divided into 2 major categories - Classifieds Based and Transactions Based

Classifieds base - Primarily operates via subscriptions, pay per leads and advertisement on the platform.

The major players in the classifieds base are - IndiaMart Intermesh, Trade India, Exporters India, Alibaba India and the recently launched JD Mart (a part of Just Dial).

Transactions based - Operates via a commission model, inventory based model (profits earned on re-selling inventory purchased beforehand from sellers) and advertising.

Some of the major B2B players in this space include Udaan, ShopX, Jumotail, Ninjacart, Industry Buying, Power2SME, Amazon Business and Moglix.

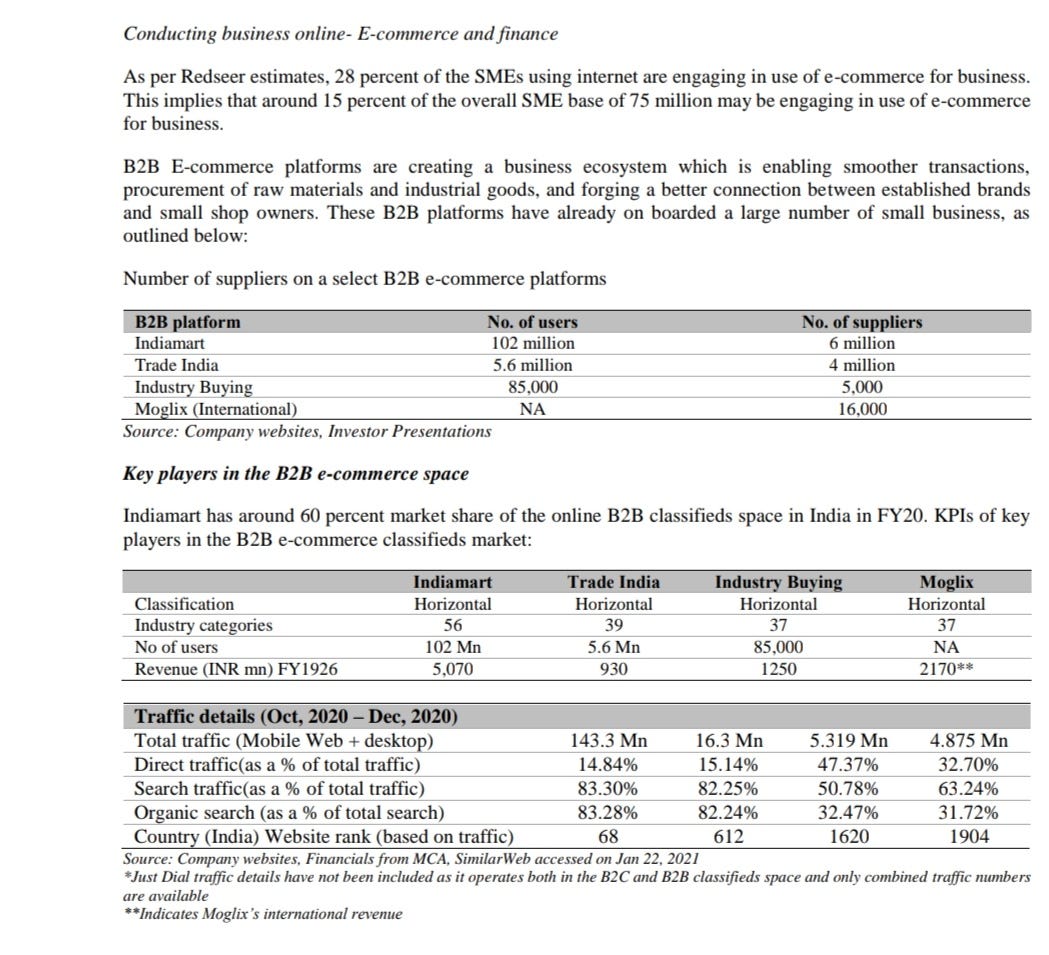

Below are some stats and comparisons across some players.

Industry dynamics -

A majority of IndiaMart subscribers are MSME’s (Micro, small and medium sized enterprises). Around 90% of the customers have turnover from 50 lakhs to crores with almost 60% of the sellers having turnover of 1-10 crore annually.

As per RedSeer estimates, the total MSME company in FY20 were 75 million. Of which, 52 million MSMEs were involved in services and 23 million were involved in manufacturing, each growing at 6.6% CAGR. MSMEs employ around 120-130 million people spread across urban and rural India. This contribution from the MSME segment to GDP stood at nearly 30 percent in FY20, with around 6 percent coming from manufacturing and around 24 percent from the service segment. The MSME market is thus strongly linked to the Indian economy.

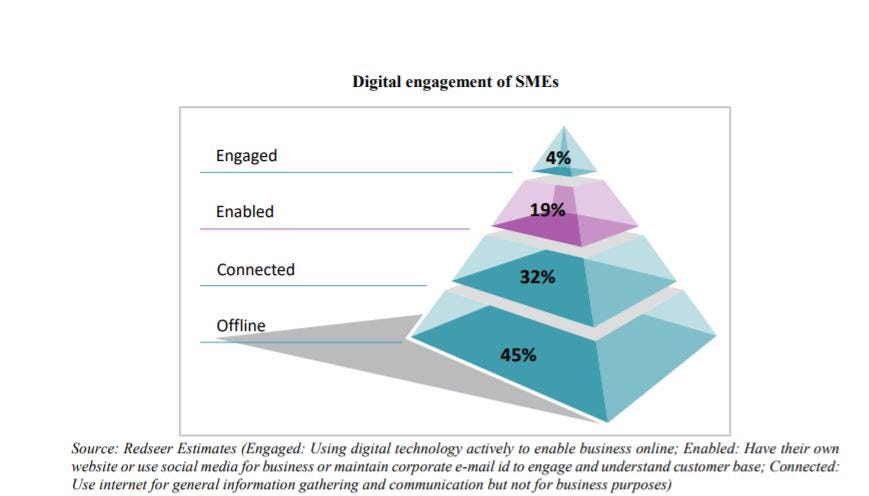

55 percent of SMEs in India are digitally connected as of 2020 and 23 percent use internet for business purposes. On the other hand, over 89 percent of all enterprises were already connected to internet in China. This shows the untapped potential for adoption for internet in the MSME’s business.

Addressable Market size for B2B Market - In India, there are over 12 million GST payers. Out of which product based B2B players are at around 3 million. Currently IndiaMart has a 5% stake of the total addressable market size. This figure has a potential to increase both as an increase in digital adoption by existing companies and a net increase in GST payers. The management of IndiaMart believe they can have a 10-20 percent market share in the long run.

The Indian Classifieds market - The digital classifieds market in India is a combination of horizontal and vertical players. The horizontals offer listing across a host of goods and services, ranging from real estate, home services, pet care, used goods to medical suppliers. On the other hand, the vertical players focus on a single product/service category such as matrimonial, recruitment services etc. The digital classifieds market in India was estimated at INR 43 billion in 2019, expected to grow at a CAGR of ~22-25 per cent over 2019-25 to reach a size of INR 140-160 billion by 2025. The global business-to-business e-commerce market size is estimated to reach USD 20.9 trillion by 2027, expanding at a CAGR of 17.5% during the forecast period.

IndiaMart Intermesh -

IndiaMart has 72 million product listings, 6.5 million supplier storefronts/companies, 125 million registered buyers and 50 million monthly business enquiries delivered. IndiaMart has 1,52,000 paying subscriptions with an Average Revenue Per User /Subscriber(ARPU) of INR 43600 per customer as on 31st March, 2021.

A similar company in China, 1688.com was incorporated in 1999, and is a subsidiary of Alibaba Group holding company. It is one of China's leading online business-to-business (B2B) marketplaces, with 120 million users and 10 million companies listing their products on the site and earns revenue through subscriptions.

1688.com has around 900,000 paying members. The business of 1688.com has done very well across the last few years primarily due to an increase in the average revenue from paying members for the past 3 years despite the fact that there has been no major increase in the number of subscriptions.

FY 2018/ 2019/ 2020 - RMB7,164 million / RMB9,988 million (+39%) / RMB12,427 million (+24%)

Average Revenue Per User - 7960RMB (INR 81,988) / 11098RMB (INR 1,18,738) / 13807 RMB (INR 1,54,000)

IndiaMart is at a very nascent stage whereas 1688.com is at a much mature stage providing a host of additional services in the areas of payments, tax invoicing and basic management software and incremental services.

1688.com does 1.5 billion USD in sales almost 20 times what IndiaMart does (due to having 6x more subscribers and more than 3x ARPU) and is still growing at very high rates which shows the possible runway IndiaMart has, if it executes efficiently. 1688.com has EBITDA margins of over 50 percent, while IndiaMart has a sustainable EBITDA margin in the range of 35-40 percent. Investments in technology and value add products will keep the range lower than the more mature 1688.com at least in the near future.

Growth in subscriptions and ARPU -

IndiaMart over the past few years has managed to grow the topline due to 2 factors

Increase in paying subscribers in the range of 15-20%

Average Revenue Per User increase by around 5-6%

Increase in subscriptions can be expected to grow post-covid in the future due to low internet penetration, recovery of Indian economy and entry of newer businesses in India.

As the subscriptions mature in the future, value addition products/services addressing the pain points and offering more utility to MSME will be driver for growth (as seen in the case of 1688.com).

Below are the pain points and potential growth areas for MSME.

IndiaMart have made investments in the following companies -

Simply Vyapar Apps Private Limited (26% stake) - Last round valuation 116 crores. Accounting and tax invoicing company.

TruckHall Private Limited (25.02 % stake) - Last round valuation - 44 crores. Online Marketplace and software development for the logistics industry and managing Superprocure that digitises freight sourcing.

Legistify Services Limited (11.01 % stake) - Last round valuation round 11.8 crores. Through its SAAS based ERP tool “Legistrak” offers organizations to manage legal workflows such as litigation tracking, notices management and legal vendor management.

Shipway Technology Private Limited (26 % stake) - Last valuation round - 70 crores. Shipway Technology Private Limited is engaged in the business of developing SaaS based solutions which allow small businesses to automate their shipping operations.

Mobisy Technologies Private Limited (8.98%) - Last valuation round - 111 crores -Mobisy owns Bizom which is an integrated platform for distribution and salesforce management of businesses.

This is over and above their in-house CRM, lead manager and payment gateway.

The above investments signify that IndiaMart wants to create a one stop shop for addressing all MSME needs. The company expects one large ticket size acquisition and multiple smaller investments which are synergistic to the IndiaMart model over the next year.

Management Quality - The management is pro-active and Mr. Dinesh Agarwal is well known and well respected in the Indian tech startup scene. A few instances which further solidifies claim of quality of management are

Trade India was the largest player in the B2B space when IndiaMart joined at 10x the size of IndiaMart. Currently India Mart is 4x the size of Trade India which shows effective management. This is similar to NSE disrupting the stock exchange platform and dislodging BSE from the top spot.

Cost control during Covid times - The management was very agile in controlling costs in time of Covid-19 and adapting to more contactless customer communication from Q1 2020 which resulted in operating margins jumping from 25-30 percent to 50 percent. It is evident that some of the costs will come back and margins will eventually settle at 35-40 percent, but it is a great indicator of the quality of management.

Raising of QIP of Rs.1070 crores for organic and inorganic growth when the share price rose dramatically is a good sign and gives them enough resources to compete

Market Leader - In a platform business, it is usually a case of winner takes all. It is almost impossible to disrupt a strong market leader in the platforms business. For example National Stock Exchange, Indian Energy Exchange and Multi Commodity Exchange. In the B2B classifieds space IndiaMart is a market leader and it is very difficult for any company to disrupt the same.

Cash and Investment in books - The company has cash and investments balance of 2365 crores or 10.7% of the current market cap. Also due to the subscription model and negative working capital days, the company has very robust cash flows which can provide additional opportunities for growth via organic and in-organic opportunities and also provides a buffer if there is increased competition.

Challenges for IndiaMart

Slower growth due to disruptions - Since the MSME sector is broadly linked to the Indian Economy any disruption or slowdown also impacts IndiaMart. Demonetization, GST, Economic growth slowdown and Covid-19 lockdowns has resulted in massive disruption especially in the MSME space, while the company has bounced back very strongly in the past, an extended lockdown or recurrence of third wave or depressed economic conditions can result in a slowdown in the growth trajectory for the company. The Q4 growth of 4K subscribers which is seasonally the best quarter for IndiaMart is an indicator of the pain in the MSME sector. Q1 is expected to be washout, with a slight de-growth in number of subscribers a possibility.

JD Mart - JD Mart part of the Just Dial has ventured into the B2B classifieds space. JD Mart has gone through an aggressive advertising campaign to promote their product. While it is tough to disrupt India Mart's dominance, JD Mart can still slowdown the growth numbers by IndiaMart. Historically, JD Mart has been a company of great promises and not so great execution, but it does have resources to disrupt the market. I believe JD Mart is a few years late to the party and in the long run it won’t be able to materially effect the moat around IndiaMart’s business.

Stretched valuations - The company trades at stretched valuations of 65X FY 22 earnings (ex cash and investments) and with Q1 quarter most likely to be muted and the possibility of a third wave and further lockdowns, the company despite promising prospects doesn't provide much of a margin of safety. The subscription add rate is one key metric to monitor over the next 2-3 quarters.

Closing Remarks- I really like the industry and business model of IndiaMart and believe the internet adoption theme still has a long way to give. I believe IndiaMart is well poised structurally to grow in the long term but the current valuations leave little to no margin of safety despite dropping almost 30% from it’s all time high. However, I would not put fresh capital at the current levels not before there is a bit more clarity on bouncing back to the growth trajectory.

Disclosure - Invested at much lower levels. Not likely to add at current valuations.

Others - If you are subscriber and cannot see my emails, it is probably due to Gmail flagging off the newsletter as promotions and one would need to drag the email into inbox to fix the problem. Also, if you like the post, request you to drop a like, comment or consider subscribing to the newsletter.

Here are the other companies which have been covered (tap to open) -

Finolex Industries - PVC pipes

Godrej Agrovet - Agriculture and ancillary industries

SastaSundar Ventures - E-pharmacy

Alternative valuation method which I use - https://cashcows.substack.com/p/an-alternate-valuation-model-consistent

The best substack newsletter. Appreciate the effort you take to write these detailed articles.