#2 - Godrej Agrovet - The best way to play the agriculture theme ?

An all-inclusive bet on agriculture and ancillary industries

Agriculture is a tough space to bet on considering the dependency of the industry on external factors (monsoon) and dependency of subsidies and regulation from the government. The Indian Agriculture/Rural play can be played via a plethora of companies in the Crop Protection, Fertilizers, Agrochemicals, Seeds, Animal Feeds, Dairy, Tractors, Cements, PVC pipes and so far and so forth.

The Monsoon Gods have been very kind over the past 2 years and the Indian Meteorological Department expects a good monsoon in FY 2021. In 2020, 41.49% of the workforce in India were employed in agriculture. Agriculture contributed 20% to India’s GDP in FY 2020. The market size of agriculture industry is huge but it is mostly fragmented with no clear market leader in the entire agriculture and ancillary space. This is majorly due to the unorganized nature of business. With the possibility of Farm Bill and other measures taken by the government, there can be a huge potential for private players to increase their market share.

Despite the huge market size in Agriculture, the largest Indian companies focusing on agriculture are not huge. Below are some the largest listed agriculture companies in India focusing on agriculture and animal husbandry -

UPL - 64000 crores - 5th largest agrochemicals player in the world. Majority of revenues come from outside India.

PI Industries - 44000 crores - Agrochemicals ( 77 percent of income from exports)

Coromandel International Limited - 26000 crores - Fertilizers.

Bayer Cropscience India Limited - 25500 crores - Crop Protection.

Hatsun Agro - 19000 crores - Milk and Dairy Products

BASF India - 11800 crores - Agricultural Solutions.

Godrej Agrovet -10712 crores - Animal Feeds, Crop Protection, Palm Oil, Dairy Business, Processed food and Agrochemical.

Avanti Feeds - 8009 crores - Shrimp Feeds

Rallis India - 6900 crores - Crop Care - 70 percent from India

Bharat Rasayan - 5367 crores - Pesticides and Insecticides

Analyzing the above list, the largest player in Indian agriculture (not global) has a market cap of around 26000 crores the size of listed players is very small when compared to agriculture's contribution to GDP.

Godrej Agrovet deals across various key multiple verticals on agriculture and animal husbandry. It deals in Animal Feeds, Crop Protection, Palm Oil, Dairy Business, Processed food and Agrochemical Industries. It is the only company in the listed space which deals across the entire agricultural and animal husbandry space and is backed by Godrej Industries, one of the most reputed promoter groups in the country.

Animal Feeds - Godrej Agrovet is the leading compound feed play across Cattle (Milk), Broiler, Layer, Fish and Shrimp feed in India. Cattle and Animal Feed has margins of 6-7 % and Shrimp Feeds has margins of 8-9%. The feeds business is a high ROCE business with returns ranging anywhere from 75-90%. Animal Feeds business contracted on volume terms in FY 21 due to HoReCa (Hotels, Restaurants, Catering) segment getting impacted due to Covid-19 but better efficiency has related to expanding of margins of the company. Animal and Aqua Feeds contribute 47 percent to the topline and 35 percent to the bottom line in FY 2020-21.

With the largest player in shrimp feeds (Avanti Feeds) commanding a value of over 8000 crores, substantial growth could be seen in the aqua feeds where the company is growing rapidly.

Palm Oil - The company is the Largest domestic producer of Crude Palm oil and Palm Kernel Oil. A sharp rise in Palm oil (77 percent Year on Year )prices along with 5 percent increase in import duty is a huge benefit for the company. Last year profitability was impacted due to a whitefly attack which resulted in destruction of Palm oil production. The higher the price, the better it is for the company. As a commodity, production of Palm oil cannot be increased substantially to match demand as a palm tree requires 5 years to grow.

Also with the world moving towards biofuels which are bio-ethanol (sugarcane and corn) and bio-diesel (vegetable oils) the price increase in Palm oil can be sustainable.

Palm Oil is also a key component for FMCG companies either directly or as a raw material for consumer goods like Soaps. With high prices and a good monsoon both looking very likely this segment should see a bumper growth in FY 22.

The segment contributes 11 % and 15 % to top and bottom line respectively.

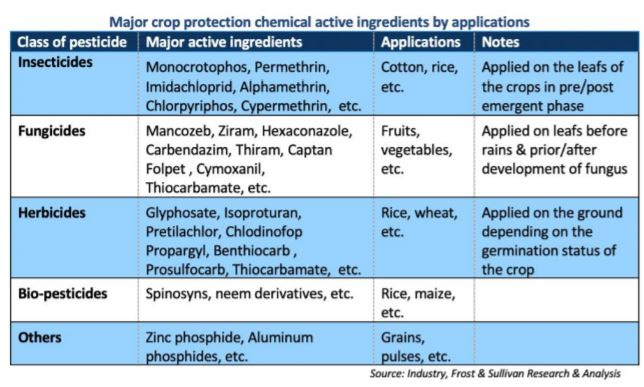

Crop Protection - Agrochemical products produced cater to the entire crop lifecycle. Crop Protection is a key contributor to bottom line accounting almost 45 percent to the bottom line of the company. The company mainly deals in herbicides. Below is the breakup of market crop protection class, ingredients and applications.

This segment has great potential and there lies tremendous growth in this segment. The company has moved to a more efficient model and has managed to increase collections by over 30%. Despite year on year performance seemingly flat, this was primarily due to lockdown restrictions in Jammu plant which resulted in a loss of around 50-60 crores in sales(~10%).

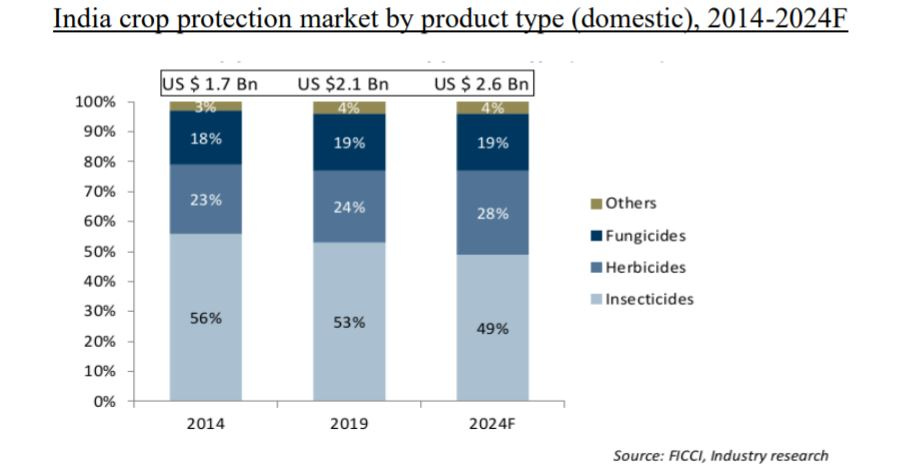

Market share of fungicides has been growing consistently and is expected to grow rapidly compared to insecticides and fungicides as shown in the chart below.

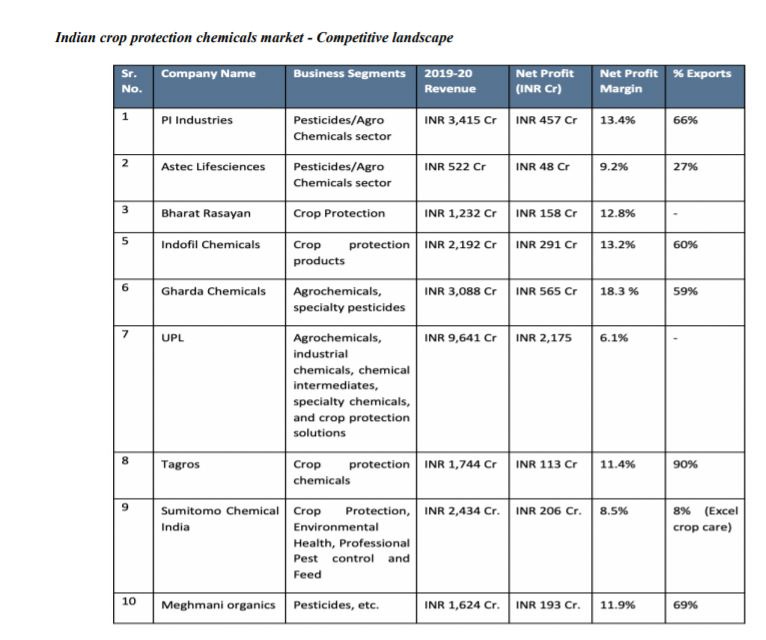

Astec Life sciences - The company is a subsidiary of Godrej Agrovet and has a market cap of around 2500 crores. Godrej Agrovet holds a 62.33 % share in Astec Life Sciences. Astec Life sciences is in the agrochemical space and is a smaller player currently but is growing consistently at over 20 percent year on year and aims to grow at a similiar rate in the near future. The biggest player in the agrochemical space is PI Industries which is almost 20+X size in terms of market cap which shows the massive potential Astec Life science has. The China +1 policy has already accelerated growth in the chemicals industry.

Below is the comparison between the largest players in the crop protection space.

Godrej Agrovet first invested around 45 % in Astec Life science at a valuation of around 375 crores and further another 6 percent at around 500 crores. The investment has yielded 5-6x in 6 years and is a good indicator of the acquisition strategy of Godrej Agrovet. The management has already hinted at a merger with Godrej Agrovet in the future in the Q4 FY 2020-21 concall.

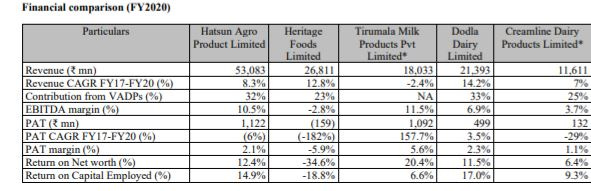

Creamline Dairy (Godrej Jersey) - The Dairy business of Godrej Agrovet. Dairy Business is a tough business to sustain thanks to co-operative societies with no profit motives and other logistical challenges with the exception of maybe one player (Hatsun Agro) who has successfully and efficiently scaled the dairy model as a company.

Below are the operational and financial parameters for Cream line Dairy and its competitors in the space which shows the huge potential available in the dairy industry.

Godrej Tyson Foods(JV) - Godrej Tyson Foods is a JV between Godrej Agrovet and Tyson Foods. Tyson foods is the world's second largest processor and marketer of chicken, beef, and pork and processed foods. Tyson Foods has a market cap of 27 billion USD and has tremendous investments in R&D space in the live birds and frozen foods business.

Godrej Tyson Foods frozen foods business (Yummiez) growth was accelerated which resulted in the topline of the company growing by 17 percent whereas the EBITDA margins improving from -9.2 % to + 7 %. The company has a 30 % market share in the non-vegetarian frozen foods business and a 8 % share in the vegetarian frozen foods business.

ACI Godrej Agrovet Limited (JV) - It is a joint venture between Godrej Agrovet and ACI in Bangladesh. The company is the second largest player in Bangladesh and is growing it's topline at over 20 percent year on year including FY 2020-21.

Other Matters - The company managed to increase its bottom line by 65% (excluding exceptional items) despite a 9% drop in topline in FY 2020-21. The promoter is consistently increasing stake and has increased the stake from 68.95% in March 2019 to 70.70% in March 2021 and the promoter group has continued buying into the company in Q1 FY 2021-22. 90.2% of the company is owned by the Promoter Group, FII and DII’s which shows the belief and quality of investors in the company.

Conclusion - In the absence of a bad monsoon and furthur disruptions to HoReCa segment due to covid, the company looks to me at a point of inflection and the start of a multi-year earnings expansion cycle. I expect an earnings growth of around 15 percent for the next few years taking into account high palm oil prices, swift recovery in out of home consumption and continued accelerated growth in Astec Life sciences and Godrej Tyson Foods.

The stock has hardly moved only by around 20 percent from its IPO price in 2017. Most of the problems which caused lower returns have been addressed and the current business model seems the most efficient. The company is still richly valued at 34x FY 2020-21 earnings but with growth and business model levers in place, I expect the company and the Indian agriculture to do very well in the long run.

Disclosure - Invested.

Market Cap at the time of the article - 10661 crores

This company is all inclusive (i will skip my investment idea on venkys now) Thanks for your information and analysis

That's a very thorough due diligence. Looking forward to more.