Panacea Biotec is one of the largest Vaccine Manufacturing Company in India and has a formulation business across therapies.

Vaccine Portfolio - (~2/3rd of revenues in FY24)

Panacea Biotec is well acknowledged by the United Nations (UN) Health Agencies in partnering the Global Polio Eradication Initiative (GPEI) with supplies of billions of doses of WHO Pre-qualified Polio vaccines in more than 50 countries worldwide.

The company has a full range of Oral polio vaccines (tOPV, mOPV1, mOPV3 & bOPV (Type1&Type3).

It is also the first company to have developed fully liquid Pentavalent vaccine (DTwP-Hep B+Hib) EasyFive in 2005. EasyFive is a WHO Prequalified vaccine being used in more than 75 countries worldwide as on March 2022.

Easy 6 - It is also the first company to have developed World’s first fully-liquid wP-IPV based Hexavalent vaccine (DTwP+HepB+Hib+IPV) EasySix. EasySix was launched in 2017 and millions of doses are produced and supplied in Indian private market.

Pharma Formulation (~1/3rd of revenues in FY24)

It also exports pharmaceutical formulations product portfolio across niche therapeutic areas such as Pain, Diabetes & Cardiovascular management, Oncology, Renal Disease, Osteoporosis management and Gastro-intestinal care.

Formulations contributed ~1/3rd of revenues in FY24.

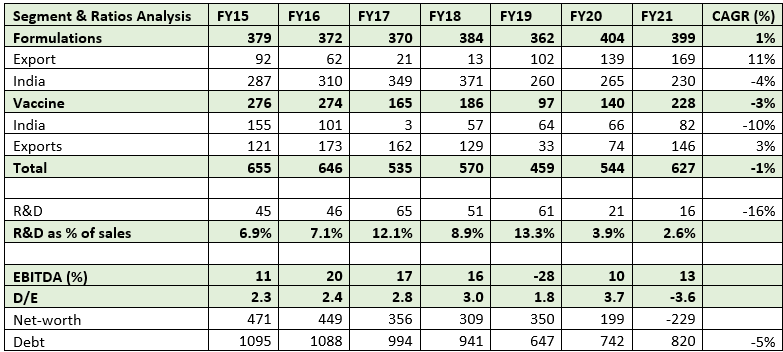

Over the years, Panacea Biotec has faced financial difficulties across cycles.

Let’s understanding what’s gone wrong in the past -

2010 - 2014 : WHO regulatory action results in massive increase in debt

Vaccine division -

Pre 2011, the vaccine division did remarkably well, receiving numerous orders from UNCIEF and WHO, which helped it grow into the main provider of Pentalvent Vaccine Easy Five (DTwP-Hep B-Hib).

However, because of deficiencies found in the plant's quality management system in Lalru (Punjab), WHO decided to remove its hepatitis B vaccine EnivacHB, Ecovac4, and pentavalent Easy five from its list of prequalified vaccines in July 2011.

As a result, its sales of vaccine exports fell by 97% over three years to Rs 25 crores, resulting in large operating losses because of fixed operating costs at the vaccine facility, remediation costs, and increased R&D expenditures for investing in the rapidly expanding US and EU generics formulation markets.

Formulation -

Simultaneously, the company focused on the export market rather than the fast-growing, high-margin, cash flow-accretive domestic market, which resulted in poor performance all round due to higher competitive intensity and pricing pressures in exports.

As a result. D/E nearly doubled to 2 times by FY14 from 1 time in FY12.

2014-2021 : Implemented corrective measures, but not enough to revitalize and change the course of action

Vaccine Division -

The company restored the Pentavalent Vaccine (Easyfive) to WHO Pre-qualification in October 2013 and resolving the regulatory action at the Lalru Plant marked the beginning of the appropriate steps. UNICEF also awarded it a long-term supply for the 2014–17 timeframe.

However, its vaccine segment grew from FY20 onwards due to a Russian partnership for the COVID-19 vaccine type, while India Peaditric vaccine saw parallel growth from FY14–18 due to the introduction of newer products (Paclitaxel, Bendamustine Hydrochloride, Docetaxel Trihydrate, Gemcitabine hydrochloride, Bortezomib, Cabazitaxel, and Azacitidine injections) across therapies like organ transplantation, nephrology, oncology, and diabetes.

The company had developed R&D costs for creating newer vaccines (dengue virus, pneumonia, and hexavalent.

Formulation -

For its leading products (Sitcom, Glizid, Livoluk, Alphadol, Nimulid, Toff, etc.) in the fields of pain and fever, gastrointestinal, and orthopedics, it also boosts efficiency, reach, and MR Productivity.

However, even after taking positive actions, the company was losing more money due to increased cash burn across the US generics export markets along with higher operating costs, R&D costs for creating newer vaccines (dengue virus, pneumonia, and hexavalent), and finance costs.

Additionally, from FY19 onward, India's formulation sales declined owing to the COVID-19 downturn and remained flat, which ultimately forced them to raise money from the India Resurgence Fund at an extremely high cost of debt. As a result, D/E reached an all-time high of 4 times in FY20.

What changed? -

From 2021 onwards : Debt repayment and asset sale -

Panacea made the decision to sell its India formulations business brands and rights to Mankind Pharma for Rs 1872 crores, which resulted in Panacea being debt-free and having net cash of Rs 150–200 crores, which it ultimately used as working capital to expand its vaccine tender and formulation exports business.

The money was also used to make investments in the development of innovative next-generation vaccines that are currently undergoing trials for diseases like dengue, pneumonia, hepatitis A, and others.

Where is Panacea placed now ?

1) “Hexavalent Vaccine (Easy Six)” -

Focusing on scaling up the high-value sticky vaccine business where it has developed one of a kind product:

a) The hexavalent vaccine represents an immunization alternative to current schedules of pentavalent and standalone IPV and the need for fewer vaccination sessions and potentially higher coverage. The delay of polio eradication timelines and subsequently longer use of IPV increases the attractiveness of hexavalent vaccine as it can help reduce the risk of the premature discontinuation of IPV. In October 2021, WHO’s SAGE working group meeting on immunization recommended the use of the hexavalent vaccine in a four-dose schedule, and that the wP-hexavalent vaccine could fit in any of the existing primary series of the IPV schedule.

b) Since 2010, it has made investments in the development of an IPV-based hexavalent six-in-one vaccine that has successfully completed phase 3 trials and received regulatory approval (DCGI) in 2016. Since 2017, it has made history by being the first business to introduce the first wP-IPV-based hexavalent vaccine in India.

c) The Serum Institute, which is among the top 7 vaccine manufacturers worldwide based on value and the largest globally by volume, has formed a partnership with Panacea in order to launch its hexavalent easy six vaccines across low- and middle-income countries as well as to secure important raw materials like IPV Bulk for manufacturing hexavalent vaccine. There are only three players across the globe who have technology and expertise for making IPV.

Additionally, DFC (US Govt) has committed US$20 Million Long-Term Loan to Panacea Biotec Towards Capacity-Expansion Project for Hexavalent Vaccine

d) According to Gavi and WHO, the peak demand for hexavalent vaccine would be around 300 million doses by 2030, creating a market opportunity of $1.25–1.50 billion.

2) Paclitaxel – From Cash guzzler to Money Spinner ?

Why Panacea Biotec would benefit greatly from the launch and commercialization of Paclitaxel?

a) It is a chemotherapy drug. It targets fast dividing cells, like cancer cells, and causes these cells to die. This medicine is used to treat ovarian cancer, breast cancer, lung cancer, Kaposi's sarcoma, and other cancers.

b) Abraxane is the brand name of the medication, which is manufactured by Bristol Meyers. The medications are sold for $811 million a year worldwide.

c) We learned from reading about the history of Paclitaxel - Taxol (Taxol Bravifolia) that it took more than 30 years for Taxol to be recognised in the United States due to its challenges with isolation from a plant, and later on, the development of a synthetic route proved to be very challenging. Imagine the challenges involved in creating and producing the nano particle-based formulation of Paclitaxel.

d) Panacea invested Rs 299 crores in research and development (R&D) (Testing, developing, raw materials) for the creation of paclitaxel and Rs 150 crores in a commercialized oncology plant for this crucial medication that may have continued to lose money if the young scientist from the company had not cracked the development process.

e) Under the terms of their collaboration agreement, Panacea Biotec will manufacture, research, and develop the product at its cutting-edge pharmaceutical formulations facility in Baddi, Himachal Pradesh, while Apotex Inc. will handle its marketing, sales, and distribution in the USA, Canada, Australia, and New Zealand.

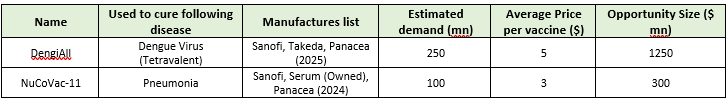

3) Vaccines for Dengue and Pneumonia (if approved) can result in~1.5 billion USD market

The introduction of newer products (Dengue & Pneumococcal) based on regulators' approval of products currently undergoing drug trials will increase the product offering and revenue stream for the vaccine segment in the upcoming years:

a) In order to develop dengue and pneumococcal vaccines for the Indian and other south-east Asian markets, Panacea has spent a lot of time and money over the last decade. Both of these vaccines have also advanced to phase 3 testing, with a 2025 launch date anticipated.

b) The dengue virus (DENV), which infects mosquitoes and causes dengue in humans, causes this viral infection. With an estimated 100-400 million infections occurring each year, dengue is now a threat to about half of the world's population. India, Southeast Asia, South Asia, Central Africa, Brazil, Panama, and other tropical and subtropical regions of the world are all home to dengue.

c) Panacea has been creating a dengue vaccine in India using technology that was in-licensed from the National Institutes of Health (USA) for expansion and commercialization. Additionally, this vaccine can protect against four serotypes/variants of the dengue virus, as opposed to the two (Sanofi, Takeda)currently available vaccines that have been commercialised and only protect against one or two variants worldwide.

d) Pneumococcal disease can have an impact on a variety of organ systems and result in pneumonia, meningitis, bacteraemia/sepsis, sinusitis, bronchitis, and middle ear 800,000 children's deaths from pneumonia worldwide in 2018, it continues to be the leading infectious disease killer of children under five. Children under the age of five are especially vulnerable to developing severe pneumonia and dying from it. More than 80% of paediatric pneumonia deaths take place in the first two years of life. Sub-Saharan Africa, South Asia, and India are where it most frequently occurs.

e) Nucovac-11, a vaccine being developed by Panacea, will offer defence against 11 of the most prevalent disease-causing serotypes. For the over 25 million babies born in India each year, the government currently purchases over 80 million doses of the pneumococcal vaccine from Serum and Sanofi. However, by the end of 2024, we anticipate that panacea will join Serum and Sanofi as a third manufacturer, opening up enormous social and economic opportunities for them and all of our other stakeholders.

4) Revival of Core Vaccine Business -

Governments and health organisations all over the world are again concentrating on routine immunisation programmes (Easyfive and Easyfour) for newborn children and infants, whose immunisation rates have been severely impacted by the arrival of the COVID-19 pandemic over the period (2020–2022):

a) A child is protected from five serious illnesses with the pentavalent vaccine (five in one): diphtheria, pertussis, tetanus, hepatitis B, and hib. Giving a child the pentavalent vaccine lowers the number of pricks they receive while also protecting them from all five diseases. Pentavalent vaccines continue to be the cornerstone of the partnership between EPI and Gavi.

b) The DTwP-HepB-Hib pentavalent vaccine is the cornerstone of the global expanded immunisation programme and of gavi engagement in childhood vaccination. Gavi-supported nations develop childhood prevention plans; the effectiveness of their implementation affects the development of important national health systems and equity.

c) Panacea has been prequalified by the WHO to supply Easy-five and Easy-four vaccines since 2012. However, the majority of sales of these vaccines take place in the institutional market, where average realisation is much lower than in the private market where Easysix accounts for a larger revenue share for the company.

d) In October 2022, it won contracts worth Rs 1048 crores from UNICEF and PAHO for the supply of the easy-five vaccine over the course of FY23–27.

This may result in vaccine division sales averaging Rs 325–375 crores annually, up from an average of Rs 225–250 crores over the previous few years. Due to higher fixed-cost investments, these higher-order wins would result in higher utilisation rates, which would increase operating leverage. Due to lower operating sales scale, higher fixed costs, lower utilisations, and higher leverage in the past, Panacea's vaccine segment has lost money at EBIT levels for the past five years.

However, over the past few quarters, it has turned around its operations and is now profitable at EBIT margins in double digits.

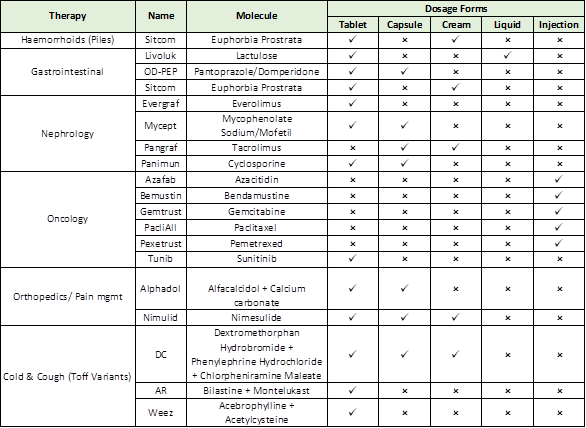

e) Concentrating on expanding the branded formulations business in high-growth emerging markets:

a) Panacea is concentrating on expanding its branded formulations business, which accounts for 80% of all formulations sales over the course of FY23 and has high double-digit margins (20-25%). And the majority of sales are produced in emerging nations like Russia, the Commonwealth of Independent States, Africa, South East Asia, and South Asia, where they have partnerships with reputable distributors or partners who offer a direct end-to-end customer reach.

b) It primarily focuses on sales in therapeutic areas like oncology, nephrology, gastroenterology, and others. Following are specifics on the molecules sold by the panacea under each product, broken down by dosage form:

2) Entering into Niche Nutrition segment with less competition & having same channel distribution similar of Pediatric Doctors which cater to Vaccine segment.

a) Nutrition, thus assumes more importance than ever before – with constant distractions from modern-day necessities, pressures of life, stress, pollution, adulterated foods, etc. that compromise our habits and the quality of our food. It is now commonly known that every rupee spent on vaccination gives a return of 54 rupees – the highest impact that can be generated through social development programs! Nutrition ranks second with an impact score of 38 rupees per rupee spent.

b) The Rs 530 crores Indian child nutrition market is projected to rise at a rate of more than 15% annually over the next five to seven years as a result of rising public, government, and medical awareness. The sensitive nature of this market also contributes to higher brand stickiness, and we anticipate less competition overall, with the exception of MNC pharmaceutical giants Abbott & Nestle, who dominate it due to their longevity, strong brands, and connectivity with pharmacies and doctors.

c) Panacea has developed its product portfolio at its Sampann R&D Center and has set-up a new Ultra-Modern manufacturing facility to manufacture these products with highest Global quality standards within its existing premises at Baddi, Himachal Pradesh. Also, launched the products under the brand name TM ChilRunfull , ChilRun® 7+, ChilRun® No Sucrose across India covering 100 districts and 4000 doctors.

Key Risks -

Compliance Risk

The financials and return ratios of the company could suffer if the USFDA, WHO, or any other regulatory authorities banned even one of the facilities due to non-compliance.

Additionally, Baddi unit received 8 observations along with an OAI (Official action indicated). Therefore, the USFDA would limit approvals for pending products by issuing warning letters if the company doesn't get its observations compliant or deteriorates into further complaints.

Lower tender or order wins, and utilisation levels will have an impact on the firm’s financial health and ratios.

Governments, health organisations, and foundations' slower adoption of the Easysix, Easyfive, Easyfour, and Bivalent Polio vaccines would result in slower ramp-up of sales growth, which would affect operating margins due to higher fixed costs and lower utilisation. This would ultimately result in higher cash burns, and lower return ratios, which would increase leverage to pay for losses, business operations, and research costs.

Future R&D pipeline failure in receiving approvals or passing trials

The financial strength and future growth of the company may be significantly impacted if R&D pipeline products (such as NuCoVac-11, DengiAll, Hepatitis A, Td, NuVac-23, and others) fail to pass trials.

Contingent Liabilities

Loss of Arbitration proceedings started by Apotex for claim amount $119 million could wipe out the entire net-worth.

Arbitration loss

Arbitration has been started for delay in seeking approval from USFDA for the product mentioned in the agreement date 9th May 2024 under the Collaboration Agreement for Research, Development, License, Supply and Sale of Products between both of them.

Panacea Stand on Above Arbitration & Contingent Liabilities

Panacea believes that the Company is not in breach of its obligations and the claims filed by Apotex are frivolous, unsubstantiated, premised on fundamental factual misstatements and incorrect legal assumptions regarding the Collaboration Agreement, and contrary to the overwhelming facts and evidence. Based on the assessment of the Company, the outcome of this arbitration proceeding is not reasonably expected to have any material financial impact on the Company or its material subsidiary.

Conclusion -

Broadly, Panacea is in an extremely interesting cross roads, where the company’s trajectory over next 3-5 years could be meaningfully different (both positive or negative) depending on how things highlighted above shapes up.

Disclosure - We are not registered under SEBI. All information above is based on public sources and due diligence conducted by us. We may or may not have invested in stocks which write above.

If you like the post, kindly subscribe and share our post / substack across.

For other older posts kindly refer to -

1) Automobile OEM -

2 Wheelers - https://cashcows.substack.com/p/all-you-need-to-know-1-automobile

4 Wheelers - https://cashcows.substack.com/p/all-you-need-to-know-2-automobile

CV - https://cashcows.substack.com/p/all-you-need-to-know-2-automobile-686

Tractors and Others - https://cashcows.substack.com/p/all-you-need-to-know-44-agri-and

Bajaj Holdings and Investment - https://cashcows.substack.com/p/5-bajaj-holdings-and-investment-limited