#5 - Bajaj Holdings and Investment Limited - Strong holding company with a deep discount to its intrinsic value

The holding company discount in India is stark compared to it's foreign peers.

Bajaj Holdings and Investment Limited is a holding company with strategic investments in listed and unlisted Bajaj group companies and financial investments in other equity shares, fixed income securities and investment in properties. The company is a case of markets attaching a deep discount to its intrinsic value (underlying investments). Usually holding companies trade at a discount of 20% in the foreign markets but in India the discount can be as deep as 80%.

Let us understand first the type of holding companies -

Holding companies can be divided into three broad categories -

Core Investment - The company holds strategic and financial stakes in companies. The company has no operating business except investing and derives all of its value from its investments.

Examples - Bajaj Holdings and Investments Limited, Maharashtra Scooters Limited, Tata Investment Corporation Limited, Sasta Sundar Ventures .

Holding company with an underlying business model - The company has a standalone business which it operates but it derives a majority of it’s value from its investments.

Examples - Bombay Burmah Trading Corporation, Godrej Industries Limited, Info-Edge India Limited, Grasim.

A company with a sizeable investment- The company has a very strong standalone business but the company also has investments which are substantial in nature.

Examples - HDFC Limited, Bombay Stock Exchange, SBI, L&T.

Analyzing Bajaj Holdings and Investments Limited investments -

41.63% stake in Bajaj Finserv Limited - Market Value at 85,867 crores as on date.

35.77% stake in Bajaj Auto Limited - Market Value at around 40,774 crores

51% stake in Maharashtra Scooters Limited - Market Value at around 2140 crores.

Other investments in group companies such as Bajaj Electricals, Mukund Limited and Hercules Hoist which were valued at around 1970 crores as on 31st March 2021.

Non-strategic investments were valued at around 9,403 crores as on 31st March 2021.

The total investment value of Bajaj Holdings comes to around 1,40,154 crores. The company does not have any meaningful debt. Bajaj Holding has a market-cap of around 43,345 crores which indicates a holding company discount of 69%. This is in comparison with holding companies abroad which trade at a discount of 20%.

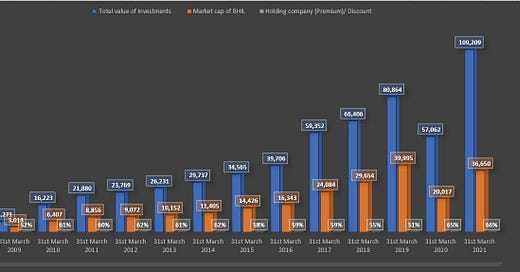

We have analyzed below market cap of Bajaj Holdings as at year end since 2008 (1st year of demerger), its investments and holding company premium discount in each year.

Attaching the chart for Bajaj Holdings and Investment Limited -

As one can see, the holding company discount of 66% as on March 31, 2021 is the sharpest in the history of the company. The gap has only widened in Q1 by another 3%. The mean holding company discount across last 13 years is at 52%.

If the valuations were to reach the mean valuations, the company would be valued at around 66000 crores, signaling a 52% valuation increase from current price.

On 31st March 2008, the company was valued at a 38% premium over the investment value and the company has seen oscillated in the holding company discount range of 35%-70%. Currently, the company offers an excellent margin of safety being at the lower range of the 69%.

Reasons for deep discount for Holding Companies in India -

Perception as value traps - Most investors stray away from holding companies as the last decade has generated returns lower than the invested companies and in some cases holding company discount has widened further lowering the returns. This is an example of companies where decent returns can be made(provided the underlying investments can grow) with a high margin of safety especially in a market where deep value has not performed well in the last few years.

Low Mutual Fund Activity - There has been very low activity by fund houses in Bajaj Holding except Parag Parikh Mutual Fund. The total mutual fund holdings as on 31st March 2021 is 1.91% of which 1.67% is of PPFAS mutual fund and balance for Nifty Next 50 index funds.

The case is similar for Tata Investment Corporation which has mutual fund houses holding of less than 1% and Godrej Industries where mutual fund houses have held 1.2%.

A deep value/contrarian fund manager entering a large holding company can significantly re-rate the sector. (Read Sankaran Naren / Prashant Jain ICICI/HDFC) both well known deep/contrarian investors.

Passive promoters - Promoters have been passive with not returning the excess money they have, some of the promoters have resorted to not paying/increasing dividend. Except for Tata Investment Corporation which went for a buyback some while ago, not many companies have tried to do anything to bring holding company discounts lower.

A criticism for Bajaj Holding lies in the fact that the company failed to increase its stake in any of the group companies during the pandemic, where Bajaj group was hit severely which questions the entire investing strategy of the company as a whole.

International Case Studies -

Naspers and Prosus - (South Africa and Netherlands)

A classic example of a holding company valuation difference can be seen when comparing Naspers (the largest listed company in the African continent) and Prosus(the international internet assets division of Naspers) . Naspers and Prosus both are related companies and a majority of value comes from its share in Tencent and other invested companies.

Naspers is listed on the Johannesburg Stock Exchange and was trading at 35 percent below its Net Asset Value.

Meanwhile Prosus is listed on the Amsterdam stock exchange and was trading at a 20 percent discount below its Net Asset Value.

Recently both Naspers and Prosus announced a share swap deal to try and reduce the holding company discount of the Naspers.

As we see, relative mature markets have a smaller holding company discount than the emerging markets one, however the holding company discount

Poongsan Holdings - (South Korea)

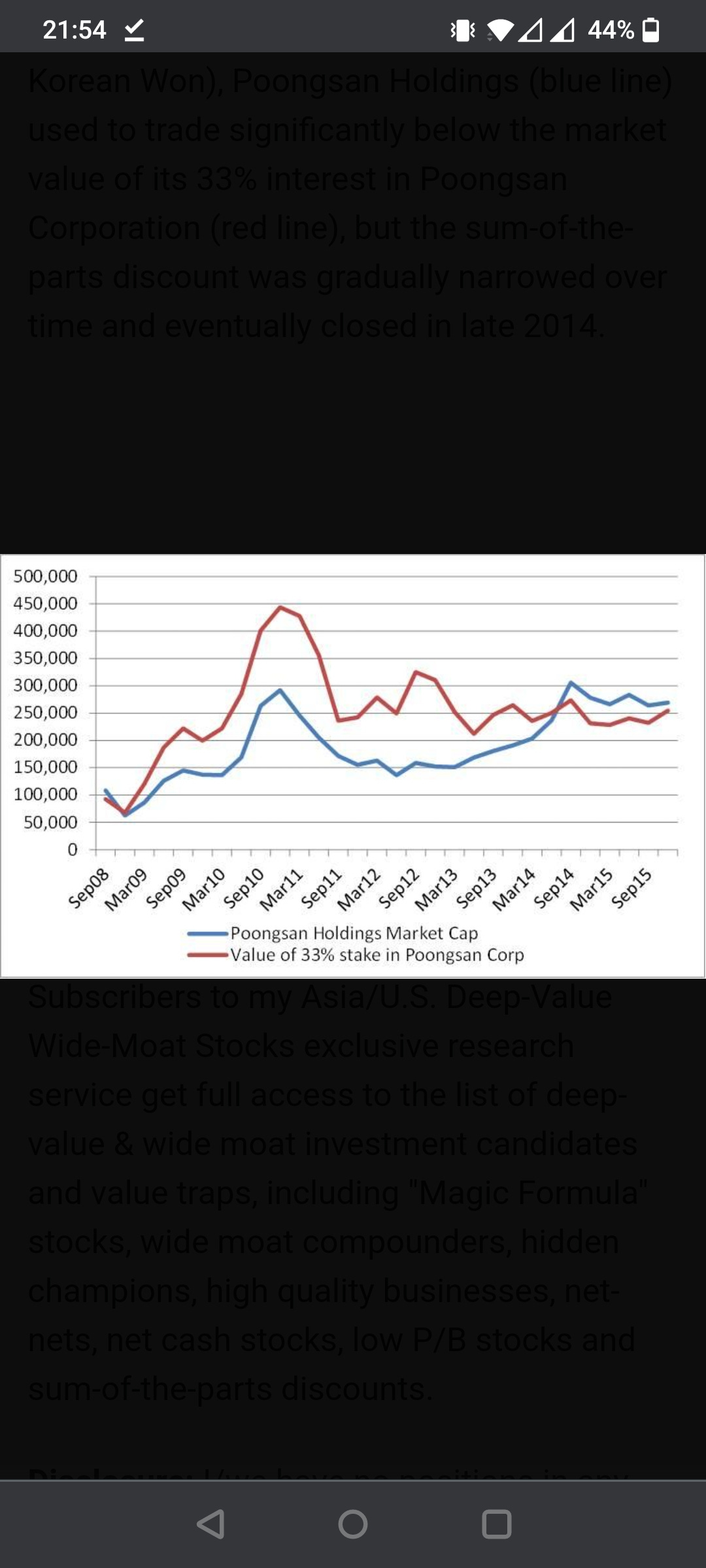

An older case study, Poongsan Holdings is a holding company with multiple operating subsidiaries whose most significant holding is its 33% interest in Poongsan Corporation, a manufacturer of fabricated non-ferrous metal products which Poongsan Holdings spun off in 2008. As per the chart below (the Y-axis is the market capitalization or value in millions of South Korean Won), Poongsan Holdings (blue line) used to trade significantly below the market value of its 33% interest in Poongsan Corporation (red line), but the sum-of-the-parts discount was gradually narrowed over time and eventually closed in late 2014. This shows that markets can discount holding companies for a period of time but the deep holding company discount can be bridged. Though the holding company discount has come back as on date, the holding company discount as on date is at 19% in line with the other peers.

The case for Holding companies - Even in some extreme cases, the holding company discount for most companies is limited to around 40 percent and there are ways to reduce/eliminate the holding company discount by either reverse merger, a large buyback or a material unlisted company getting listed.

Accelerated returns - Holding companies trading at a very steep discount may give accelerated returns from 2 avenues.

Increase in the underlying investments

Reduction in holding company discount.

An example of the same, is if the underlying investments grow by 20% in a year and holding company discount reduces from 70% to 50% the total returns for holding company will be a 100% increase.

Reverse Merger - The easiest way to narrow holding company discount is to reverse merge where the holding company merges with a company it is invested in.

Take the case for Equitas Holdings and Equitas Small Finance Bank or Ujjivan Financial services and Ujjivan Small Finance Bank. The holding companies are reverse merging with the SFB which is their investment. Due to reverse merger, Equitas Small Finance Bank will be the only listed company when the merger is complete and shareholders of the holding company will receive shares of SFB. This will substantially narrow or may even eliminate holding company discount.

Other holding company which may reverse merge is Bandhan Bank with Bandhan Financial Services and HDFC Limited with HDFC Bank.

Most reverse mergers are done for 2 things, shareholder value unlocking and reduction/elimination of promoter share for Banks(including SFB).

Another classic case which I covered a few weeks ago could be reverse merge in the future could be Sastasundar Ventures with Sastasundar HealthBuddy Limited (the e-pharma unit of Sastasundar).

Value unlocking - Value unlocking may happen when an unlisted share in the books gets listed which results in a re-rating of the company.

Go Air has filed for DRHP which could see some value unlocking for Bombay Burmah Trading Corporation.

Similarly a listing of Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance may unlock value for Bajaj Finserv which in turn would help unlock some value for Bajaj Holdings. Bajaj Holdings also holds unlisted shares of companies such as NSE, FabIndia and India Commodity Exchange Limited which may unlock some value if and when they list strongly.

The listing of Zomato and Policy Bazaar may unlock value in Info-Edge India.

Holding Companies Premium -

Not all holding companies trade at deep discounts, some trade at high premiums to its NAV.

Info-edge (India) is one such example, Info-edge has a very strong operating business via Naukri.com a job portal however most of the value for the company comes from its unlisted investments primarily in Zomato(to be listed soon) and Policy Bazaar and other unlisted invested companies. Even after factoring the unlisted investments at a not so conservative basis, the company still trades at a premium.

Another example is of Xelpmoc Design and Tech Limited who trades at a significant premium to its value of investments (primarily Mihup and Fortiga).

In both the cases, the common point is both companies invest in early stage startups and the market does not attach the same holding company discount to these companies.

Attaching a list of some of the holding company and their primary investments -

Bajaj Holding and Investment Limited - Pure Holding Company - Major Investments - Bajaj Finserv, Maharashtra Scooters and Bajaj Auto Limited

Godrej Industries - Standalone Business - Chemicals - Majority Holdings - Godrej Properties, Godrej Agrovet and Godrej Consumer Products Limited

Tata Investment Corporation - Pure holding company - Titan, Tata Consumer Products, Trent, Voltas and Tata Capital (unlisted)

Kama Holdings - Pure holding company - SRF Limited

Maharashtra Scooters - Pure holding Bajaj Finance, Bajaj Finserv, Bajaj Auto and Bajaj Holdings.

Sastasundar Ventures - Pure holding - SastaSundar HealthBuddy Limited (unlisted)

Grasim Industries Limited - Standalone business Chemicals - Ultra Tech Cement and Aditya Birla Capital.

Nalwa Sons Investments - Pure holding company - Jindal Saw, JSW Steel

Kalyani Investments - Pure holding company - Pure holding company - Bharat Forge, BF Utilities

EID Parry - Standalone business - Sugar and nutraceuticals. Carborundum Universal, Cholamandalam Investment and Finance Limited and Coromandel International.

Pilani Investments - Pure Holding Company - Century Textiles and Industries Limited, Grasim Industries Limited, Hindalco Industries Limited, UltraTech Cement.

Ujjivan Financial Services - Pure holding company - Ujjivan Small Finance Bank

Equitas Holdings - Pure holding company - Equitas Small Finance Bank

Bombay Burmah Trading Corporation - Primary business - Tea and Coffee Plantation. Major holdings - Britannia Industries, Bombay Dyeing and Go Air.

Sundaram Finance Holdings - Turbo Energy, Brakes India, Wheels India, Sundaram Clayton, Indian Motor Parts and Accessories Limited

L&T - primary business - Infrastructure - L&T Infotech, LTTS and Mindtree.

Others - SBI, ICICI Bank, Kotak Mahindra Bank, Axis Bank, HDFC Limited, HDFC Bank, Aditya Birla Capital.

Conclusion - The first rule of buying a holding company is ensuring that the underlying investments are solid, ideally would stick to larger companies. Companies who do not pay dividend or and have high debt are unlikely to be re-rated significantly.

Buying a holding company where it is in the lower end of historical average is a decent way to ensure a margin of safety, most holding companies fall in that category currently.

Also, most of holding companies move together so incase a large holding company reduces holding company discount rapidly , the smaller holding companies should also reduce the holding company discount albeit a time lag.

Bajaj Holdings provides a good margin of safety owing to strong underlying assets and a deep discount to its underlying investments(almost at the largest in it’s history).

Disclosure - Invested in Bajaj Holdings and Investments Limited.

An update - This newsletter is now the 5th largest Indian Finance newsletter by subscriptions on Substack despite joining only a month and half ago. I believe we can hit number 3 by end of the month, and hit number 1 by end of September. Thanks a lot for your support.

Other matters and other articles - If you like the post, please consider subscribing or sharing the newsletter.

Do drop a like by clicking on the heart button at the top of the article, as it helps the algorithm and recommends the newsletter to more people. Kindly drop a comment for any suggestions/criticism/queries relating to any of my articles.

For any collaborations/ideas/other matters drop an email to cashcowsindia@gmail.com

Follow me on twitter, I have more subscribers on Substack than on Twitter, trying to change it, please consider following the account if possible - https://twitter.com/CashCowsIn

Check out the other articles I have written below -

SastaSundar Ventures - A micro-cap in the E-pharmacy space -https://cashcows.substack.com/p/sastasundar-ventures-underpriced?r=n0hml&utm_campaign=post&utm_medium=email&utm_source=copy

Godrej Agrovet - An all inclusive bet on Indian Agriculture

Finolex Industries - A strong player in the Plastic pipes industry

IndiaMart InterMesh - Largest B2B classifieds player in India

Sector Coverage -

1. Spotlighting Power and Green Energy Theme -https://cashcows.substack.com/p/spotlighting-theme-1-power-and-green?r=n0hml&utm_campaign=post&utm_medium=email&utm_source=copy

Other article -

An alternate valuation model - Consistent Growth Model -

With markets at all time high levels and potentially overvalued isn't the value of investments going to be bloated thereby reflecting a deep discount. In such case shouldn't one be wary of discount as a deciding indicator?