Spotlighting Theme #1- Power and Green Energy

Disparity between valuations of power companies is stark and provides a potential investing opportunity

The Indian power/electricity sector has been one of the worst performing sectors over the last decade. Most companies have given 0 to negative return over the last 10 years (Tata Power, NTPC, NHPC), a few companies are debt laden and have been classic examples of wealth destroyers (Reliance Power and Suzlon) and even the most efficient companies have given returns lower than a FD (Torrent Power).

The underperformance of the Indian power sector can be attributed to

Poor capital allocation and heavy debt undertaken by the companies

The problem of counter-party risk for power generators from DISCOM (distributor companies)

Sector overvaluation in the early 2010’s.

Let us understand the power sector in India -

Power as a sector in India - The Indian power sector can be broadly divided into Power Generation, Transmission and Distribution (GET&D). All other companies and sectors are ancillary to the above three subsegments.

Power Generation - The Overall generation (Including generation from grid connected renewable sources) in the country has been increased from 850 BU during 2010-11 to 1381.855 BU during 2020-21 a CAGR growth of around 5%. India’s primary energy demand is expected to grow at a CAGR of 4.2% till 2040 faster than any major economy.

Of the total installed capacity in India, a majority comes from conventional thermal energy. Thermal energy contributes 61.3% of total installed capacity. Thermal energy consists of Coal (53%), Lignite (1.7%), Gas (6.5%) and Diesel (0.1%).

The balance comes from Hydro (Renewable) - 12.2%, Nuclear 1.8 % and Renewable Energy Sources - 24.8 % (Small Hydro Project, Biomass Gasifier, Biomass Power, Urban & Industrial Waste Power, Solar and Wind Energy).

By 2030, renewable energy is expected to contribute around 55% of India’s total power capacity from the current 37%.

Transmission - The natural resources for electricity generation in India are unevenly dispersed and concentrated in a few pockets. Transmission, an important element in the power delivery value chain, facilitates evacuation of power from generating stations and its delivery to the load centres. For efficient dispersal of power to deficit regions, strengthening the transmission system network, enhancing the Inter-State power transmission system and augmentation the National Grid and enhancement of the transmission system network are required.

Distribution - Distribution is the most important link in the entire power sector value chain. As the only interface between utilities and consumers, it is the cash register for the entire sector.

Large Indian companies in Power and ancillary sectors -

Adani Green Energy Limited - 1,59,436 crores - Largest green energy player in India (after acquisition of SB Energy)

Power Grid Corporation of India - 1,20,457 crores - Largest transmission player in India - 45% market share in transmission

NTPC Limited - 1,14,227 crores - Largest Power generator in India - 22.4% market share.

Adani Transmission - 1,10,036 crores- One of the largest private sector transmission players in India -

Adani Power - 42,253 crores - Electricity generation and distribution - 3.8% market share

Tata Power - 39,766 crores - Electricity generation and distribution - 4.1% market share

JSW Energy - 27,574 crores - Electricity generation and distribution -

NHPC - 26,218 crores - Hydro-electric power generation - 15% market share in hydro-electric power generation

Torrent Power - 22,839 crores - Electricity generation and distribution - 1.6%

Indian Energy Exchange Limited - 11,889 crores - Indian energy exchange is the largest energy exchange which provides an automated platform and infrastructure for carrying out trading in electricity units for physical delivery of electricity.

SJVN - 11,102 crores - Electricity generation and distribution - 0.7%

CESC - 10,527 crores - Electricity generation and distribution - 4.1%

Renewable/ Green Energy Sector -

Global Tailwinds for Green Energy -

The new Biden administration in US officially rejoining the Paris Climate Accord, renewing its commitment to achieve zero net emissions by 2050. This represents a boost for the renewable energy sector given that US is the second largest emitter of greenhouse gases.

Domestic Tailwinds for Green Energy -

Hydro-power - Hydropower has been the dominant source of renewable electricity in India for a long time. In the late 1970s hydropower alone accounted for around 40% of total electricity generation, hydro-power market share has fallen rapidly due to larger capital requirements, delays in construction of dams due to environmental and political concerns and increased availability of coal which is cheaper. The future prospects for hydro-power are very limited.

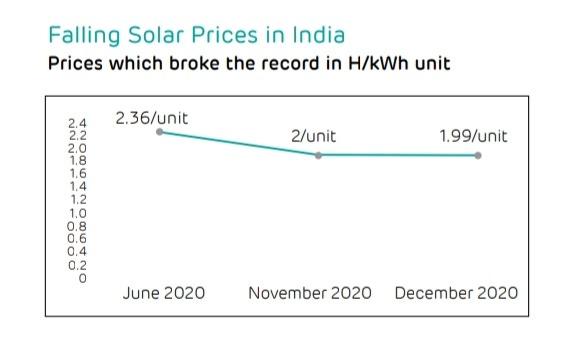

Solar and wind energy - Solar and Wind energy are the flag bearers of the entire renewable space and is expected to lead the entire Green Energy space. While he prices of fossil fuels have increased over the years, solar energy costs have been declining, having achieved grid parity a few years ago, accelerating the traction for this clean energy source. India’s solar energy potential is more than 21x its existing capacity, India’s wind energy potential is more than 9x its existing capacity signalling a multi-decadal opportunity in the renewable space.

Bioenergy - The principal source is co-generation units using bagasse residues from India’s large sugar industry. Using biomass for power generation is a more sustainable use of bioenergy resources than the traditional use in households.

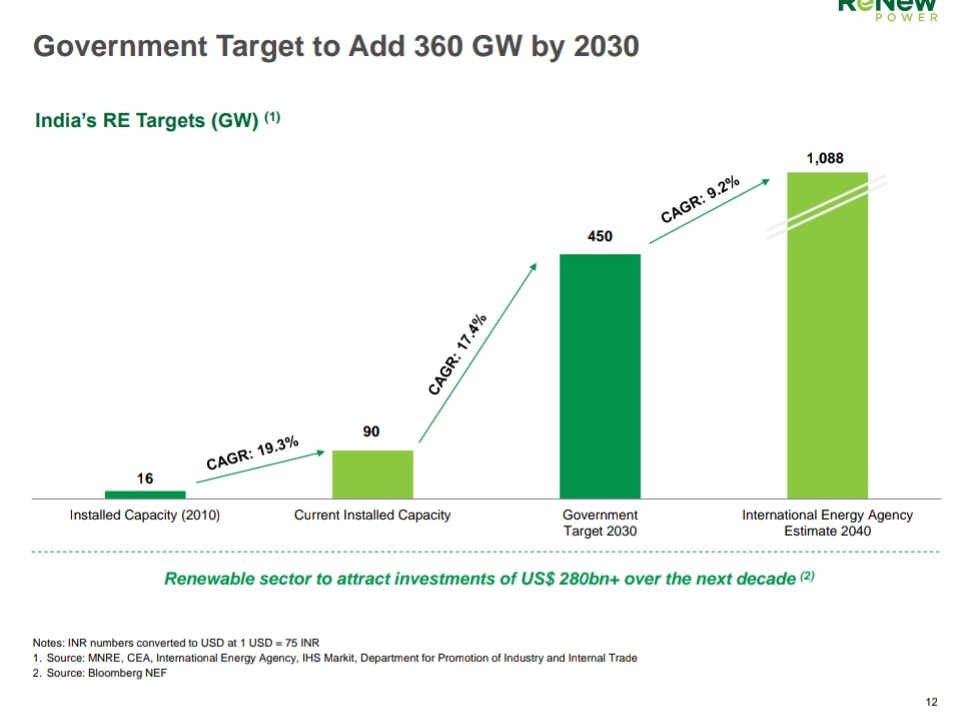

Market Size - As of 31st March, 2021, India’s installed renewable energy capacity was 94 GW; solar and wind energy capacity comprised 40 GW and 39 GW respectively. Biomass and small hydro power constituted ~10 GW and 4.78 GW respectively. India’s installed renewable power capacity increased at a CAGR of 17.33% between FY14 and FY20. and is expect to grow at a similar CAGR from 2021-2030 as the Indian Government aims to add 360 GW by 2030.

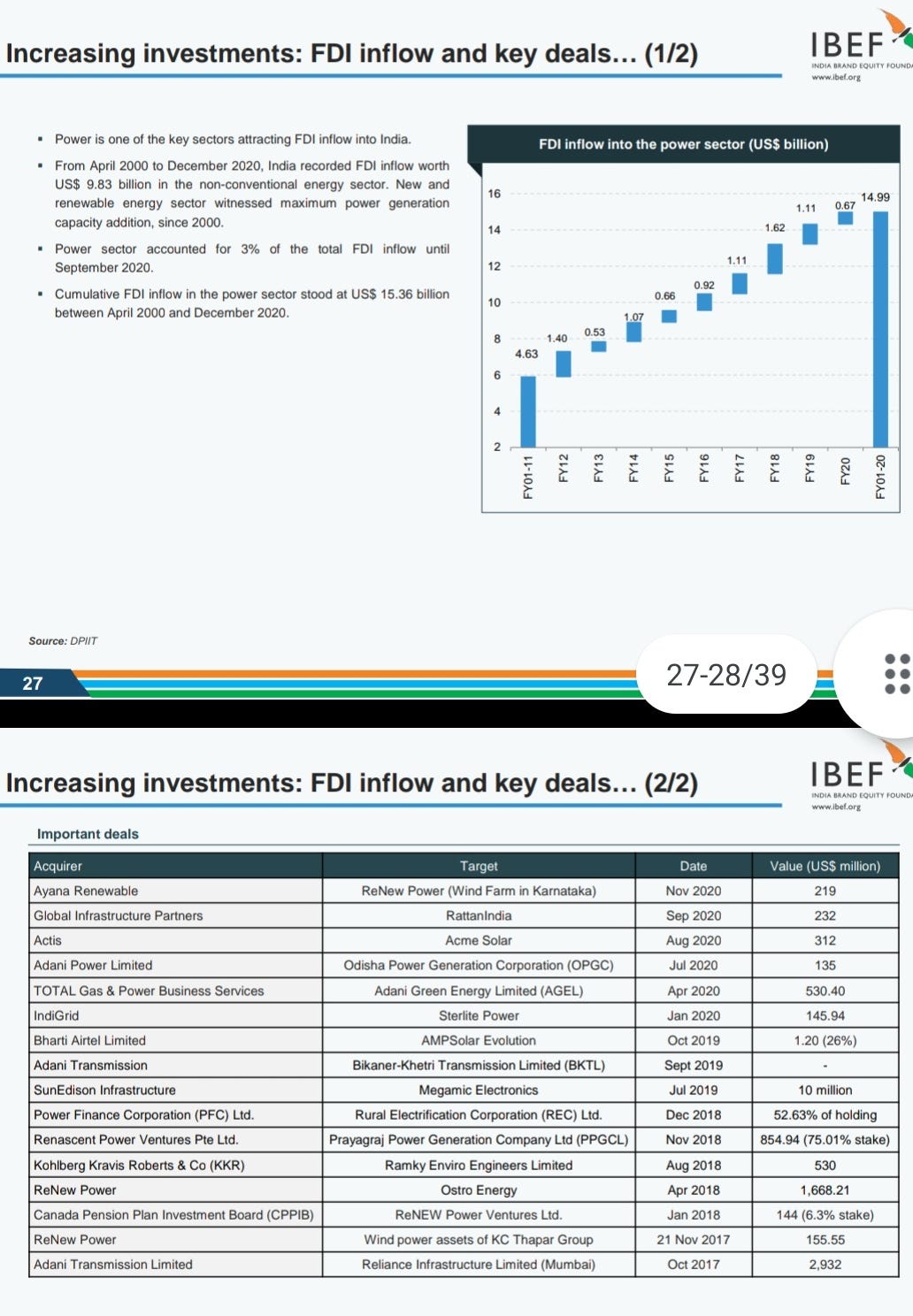

Investments in the Indian Energy/Renewable energy -

From 2000-2020, India’s renewable energy industry saw FDI inflows worth US$ 9.68 billion.

Below are the key recent deals in Indian energy and renewable energy space -

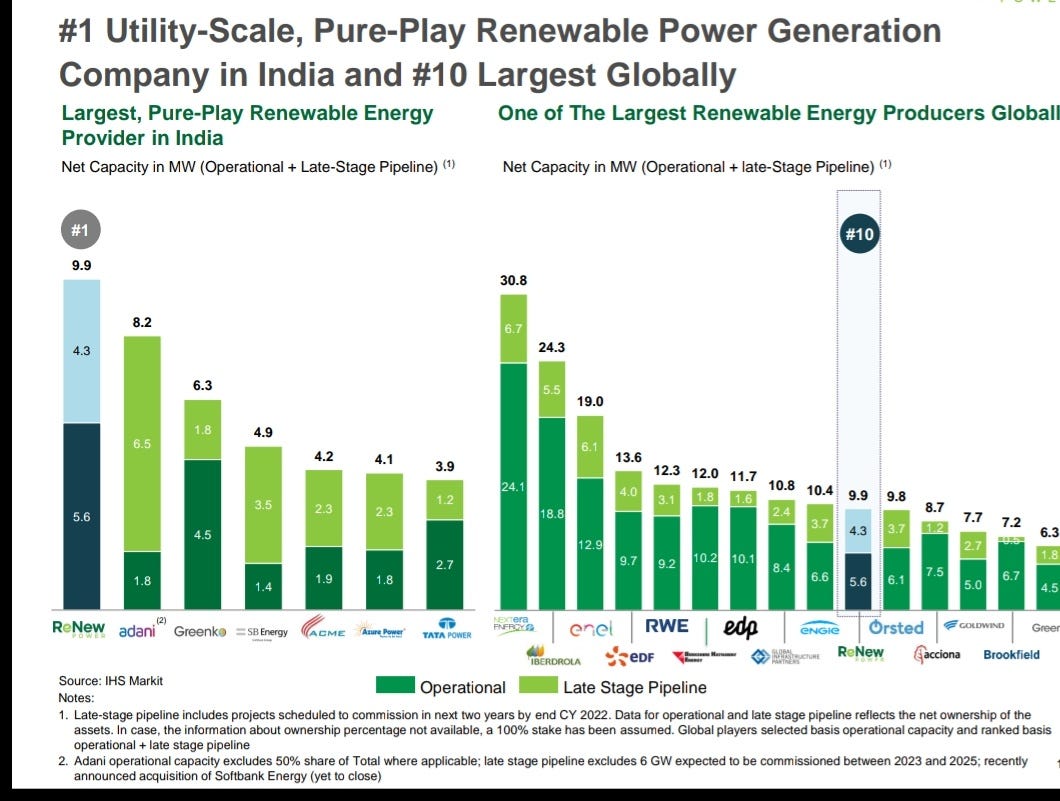

Market size, Structure and Key players - Of the top 10 renewable players in India, 2 are listed in India and 2 are listed in the US.

Adani Green's takeover of SB Energy consolidates it's position as the largest green Energy player in the country and amongst the top 5 players in the world. Among the other listed players, Tata Power is another large player in the renewable energy space.

Renew Power is the second largest player and got listed via SPAC on NASDAQ. Azure Power is another Indian player listed in the US. Below is the list of large global and Indian players in renewables space along with their net capacities.

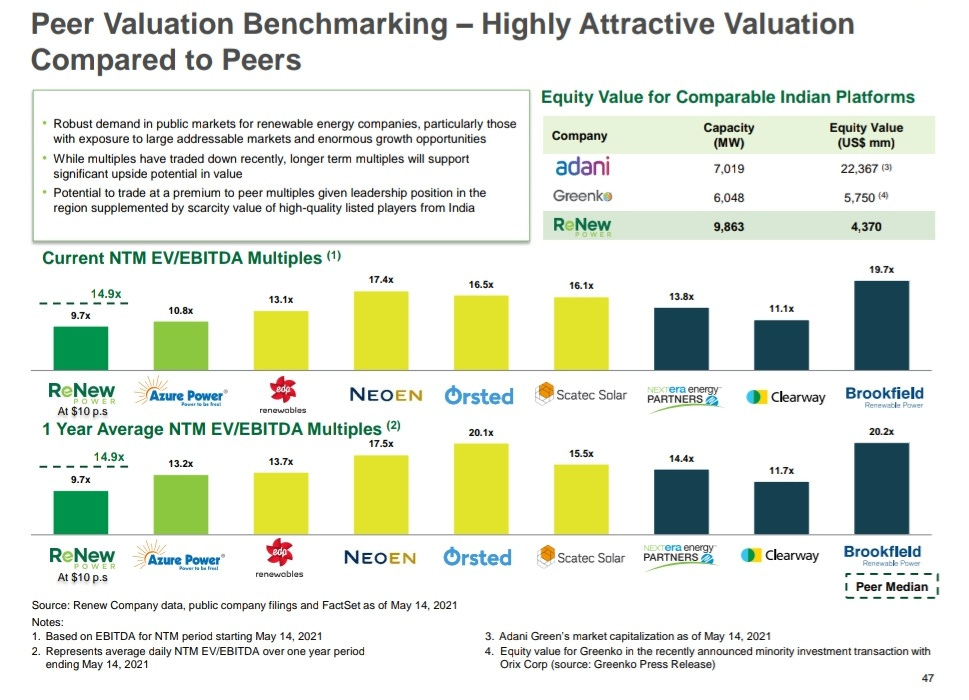

Valuations and conclusion - The valuation gap between energy stocks in India and US is enormous. While most energy stocks (ex-Adani) in India trade at very modest valuations despite having decent renewable and non-renewable assets, valuations of Azure Power and Renew Power are at a premium valuation.

Renew Power trades at 13.6 EV/EBITDA when compared to other Indian Listed companies, the global average is at 14.9 EV/EBITDA as shown below.

Global companies are trading at a median valuation of 14.9 times EV/EBITDA whereas Indian companies listed in USA are trading at a valuation closer to times EV/EBITDA.

Indian companies (ex-Adani) trade anywhere from 6.7x to 10.3 EV/EBITDA, a discount of 50-100% to their renewable energy peers.

Indian Listed players have also started building up renewable capacities and trade at modest valuations.

Tata Power trades at 10.3 EV/EBITDA

NTPC trades at 7.57 EV/EBITDA

Torrent Power trades at 8.14 EV/EBITDA

While the argument that pure-play renewable Indian companies should trade at a premium against conventional power companies is valid however most pure play renewable Indian companies have taken large debt to fund the expansion space.

Azure and Renew Power have 4x Debt to Equity which leaves little margin of error and the companies will have little to no free cash flow at least for the nearer future.

In India, most power companies are more conservative in nature, have been swiftly adding newer capacities in the renewables space and many have an earnings yield greater than the government yield of 6 percent.

Debt Equity ratio - Tata Power - 2.24, Torrent Power - 0.66 and NTPC 1.57.

Earnings Yield - Tata Power - 6.30%, Torrent Power - 7.93% NTPC - 9.16%

Conclusion - The majority of points which resulted in underperformance of power sector has been resolved.

Indian power companies have become better capital allocators and have become more conservative in taking debt.

Government has made efforts to improve DISCOM which has reduced counter party risk including liquidity infusion of 15 billion USD in 2020.

The sector is at historical low valuations

India’s power demand growth till 2040 is going to be highest of any large economy coupled with the rapid growth of green energy, low valuations and predictable growth in revenue and profitability makes it a prime candidate for rerating in the long run.

Disclosure - Currently monitoring some stocks in the theme, not invested in any of the power companies.

If you find this post of any assistance, request you to like the post by clicking on the heart, as it helps the algorithm recommend posts to more people. Leave a comment for any suggestions/ criticism and consider subscribing to stay updated.

Companies covered -

SastaSundar Ventures -https://cashcows.substack.com/p/sastasundar-ventures-underpriced?r=n0hml&utm_campaign=post&utm_medium=email&utm_source=copy

Godrej Agrovet - https://cashcows.substack.com/p/godrej-agrovet-the-best-way-to-play?r=n0hml&utm_campaign=post&utm_medium=email&utm_source=copy

Finolex Industries - https://cashcows.substack.com/p/finolex-industries-a-major-player?r=n0hml&utm_campaign=post&utm_medium=email&utm_source=copy

IndiaMart InterMesh- https://cashcows.substack.com/p/4-indiamart-intermesh-market-leader?r=n0hml&utm_campaign=post&utm_medium=email&utm_source=copy

Other articles -

An alternate valuation model - Consistent Growth Model -