SIS Limited is one of the largest company in security, facility management and cash logistics services in Asia-Pacific. The company is the largest security solutions provider in India and Australia and is amongst the top 3 in New Zealand and Singapore.

The company derives almost 50 percent of the revenue from overseas markets. The company has over 2,30,000 employees across the world. Along with providing physical security the company also provides command and control services, Closed-circuit television monitoring and entry automation.

The company also deals in facility management i.e. housekeeping services, janitorial support, integrated facility management, HVAC maintenance and pest control.

Indian Security Industry - The Indian Security industry has been projected to grow at a CAGR of 14.3% from Rs. 806 Billion in FY19 to reach Rs. 1,574 Billion in FY24 (Source: Freedonia Report on India Security Solutions and Facility Management, March 2020). Security services is a relatively stable segment, and is very unlikely to be disrupted heavily. The industry was classified as an essential service provider by the Ministry of Home Affairs during the national lockdown in 2020 due to the ongoing COVID-19 pandemic which also signifies it’s importance to the economy.

SIS derives 38% from its Security Solutions in India business. Despite being the market leader in India, the company only has around a 4% market share of the overall Security Services in India which shows the massive potential for the company to gain market share. This is partly because over 65% of market share is still in the unorganized sector(from 70% in FY 2019). The shift to unorganized to organized sector is due to focus on compliance after the implementation of the Goods and Services Tax, stricter enforcement of minimum wage bill, and the Private Security Agency Regulation Act and the recently passed Labour Reforms bills which are likely to benefit SIS India over the medium term.

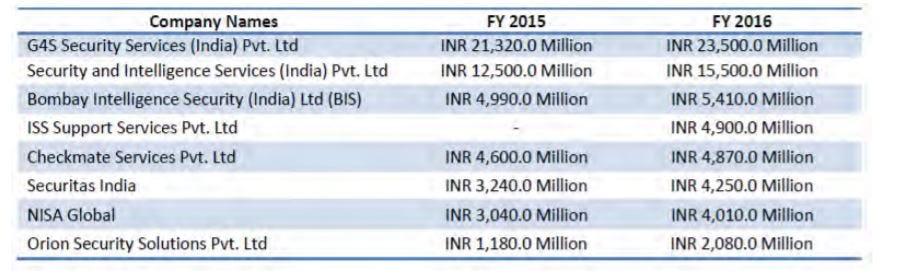

The market consists of over 20,000 small to medium sized unorganized players and around 10 national players. Below are the largest players in the Indian Security space. The data shown below is from the prospectus and the numbers are a bit older however SIS is now the largest player in the Security Space with India revenues over Rs. 35200 million.

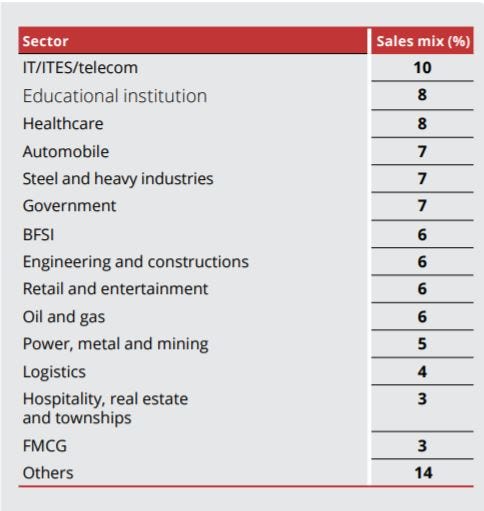

Further the industry is well diversified across sectors which prevents it from getting impacted from a downturn in one of the industry. Below is the sales mix for SIS Limited across sectors in India which showcases the diversified nature of business.

International Security Markets - SIS primarily operates in Australia, New Zealand and Singapore.

Australia is a key market for the company, the company is a market leader in Australia with a 21% market share (CRISIL). The company has acquired the remaining 49% of Southern Cross protection(SXP) which is in the mobile patrol business in the previous year thus expanding and deepening their footprint in Australia. The Australian security market is expected to grow at 5%.

The company has entered the Singapore and New Zealand Markets via Henderson Security Solutions (SIS owns 60% stake) and Platform 4 group (SIS owns 51% stake). The company is amongst the top 3 players in both the geographies.

The international security market is a bit less diversified with Government (35%), Defence (12%), Commercial (10%) and mining (10%) being the key segments for revenue in FY 2021. Government was slightly higher due to one-off government contracts in the previous year due to Covid.

SIS derives around 50% of revenue from its overseas operations (Australia, New Zealand and Singapore)

Facility Management -

The industry is forecast to grow from Rs. 1,055 Billion in FY19 to Rs. 2,328 Billion in FY24, at 17% CAGR. The market size includes housekeeping solutions, technical/hard facility management, pest control, landscaping, catering, and even solutions provided by OEM vendors under the service contracts. While this segment was impacted by the covid, the long term structural story seems intact for this industry as a whole.

Of the total industry - 62% of total market comes from cleaning services and 10% comes from pest control accounts. The balance comes from the other industries.

The company is the second largest facility management services company in India. IT (25%), Pharma (19%), Commercial offices (23%) and manufacturing (10%) contribute over 77% of the total facility management for SIS.

The company also is the second largest company in the cash logistics segment in India.

The facility management contributes around 12% of total revenue of SIS.

Key strengths for SIS Limited

Mergers and Acquisitions - The company has a terrific track record of mergers and acquisitions. The acquisition strategy is to gather/ consolidate market share by adding (new geographies or existing geographies) or add new capabilities (entry into healthcare/ pest-control etc.)

The company acquired Dusters Total Solutions Services Pvt Ltd’s whose revenue grew at a CAGR to 23% during FY17-FY19 compared to 11% pre-acquisition (FY13-FY16) and EBITDA grew at a CAGR of 58% compared to a CAGR of 33% pre-acquisition. Southern Cross Protection Private Limited was another acquisition where post acquisition growth was higher than pre-acquisition growth.

The New Zealand business has grown 5x since the JV with Platform 4.

Unorganized to Organized shift - The Indian security market is largely unorganized (60% market share) and the shift to unorganized to organized is gradually happening due to increasing economic activity and GDP growth leading to need for improved security, growth in wages, increased threat from anti-social elements and terrorist outfits, societal perception on threats and awareness on security, asset creation –real estate and infrastructure growth, and premiumization and hybrid solutions.

Despite being the largest player in India, SIS still only has a 5% market share compared to 15-20% in more advanced economies.

India also has the lower per capita security expenditure almost 6x lower than other emerging market countries like Turkey and South Africa.

Track Record - The company has a terrific track record with revenues growing at a 5 19% CAGR over the last 5 years despite the covid year. The company has also maintained a ROE of over 20%. While growth in Australia is expected to be slower at around 5% , the Australian entity generates terrific free cash-flows and has a higher return on equity of over 40% which provides a good balance to the Indian unit which is expected to grow much faster. While growth is still expected to come from Indian Security and Facility management business, a presence in the more developed economies provides stability and also gives an edge in terms of technology to the company.

Networking Benefits & New Age business -

The company across Security and Facility management have identified that almost 90% of their clients are engaged into service contracts with the company for only 1 service. The opportunity for cross-selling is high and this can leads to networking benefits playing out for the company.

The company has entered into alarm monitoring system and other I.T. based security which has grown very reasonably. This also showcases company’s capabilities in technology and a vision for the future. The market for security and automation solutions is very huge as evidenced by Apollo Private Equity’s buyout of ADT for almost 7 billion USD in 2016. .

Key Risks -

Acquisition costs - The company has to acquire Southern Cross Protection and Henderson Security much earlier than expected as the promoters of the companies enforced their right to cash out early. The acquisition of Southern Cross Protection resulted in a cash flow outflow of over 203 crores, similarly Henderson Security has also enforced the same which will result in a cash outflow of around 230 crores in the near future. While the company expects almost 85% of growth to come organically and inorganic investments are unlikely to happen in the near future, the fact that the company may need to dish out high sums of cash -flow can put a possible dent in the financial performance of the company.

Lower Growth trajectory of the overseas subsidiaries - The Australian company is not a very high growth company with the expected growth rate to be in the range of 5%, last year’s growth of over 20% was an anomaly due to government contracts due to covid and the same will be seen in the current year’s financials.

There has been a management change in Henderson Security (Singapore) and the business has not done very well during the Covid times and the earlier management has moved out after their cash out and SIS has appointed new management to takeover the business. There still lies a bit of uncertainty of how quickly the company can restart growth in the Singapore markets which can provide a drag on financials especially as the company has been acquired at relatively high valuations.

Conclusion / Disclosure - SIS is the only security related business listed in India with a terrific track record by the management. As per the latest data, the security business in India is operating at pre-covid levels and facility management is operating almost at around a 95%. In the absence of a third wave, the company can restart it’s growth trajectory from Q2.

As per vision 2025, the company expects to double market share in 4 years while maintaining over 20% ROCE, signaling a potential growth of around 19%. While growth expectations can be taken with a pinch of salt, the stock still trades at a relatively valuation of around 18 PE, when compared to other staffing peers.

Disclosure - I currently do not own SIS, however it is in my watchlist.

Please drop a like or comment as it helps the algorithm and helps people find the newsletter. Kindly follow me on twitter - https://twitter.com/CashCowsIn

Check out my earlier posts & companies I have covered.

1 SastaSundar Ventures - A micro-cap in the E-pharmacy space -

2 Godrej Agrovet - An all inclusive bet on Indian Agriculture

3 Finolex Industries - A strong player in the Plastic pipes industry

4 IndiaMart InterMesh - Largest B2B classifieds player in India

5. Bajaj Holdings and Investments Limited -

6. Elgi Equipments -

Thanks for the write-up Cash Cow. A few questions would appreciate your response:

1. These previous acquisitions - at what multiple did SIS acquire companies in Australia, NZ, and Singapore?

2. What was the reason for cash-out by the erstwhile management?

3. Would you know how the contracts with customers work? Are these long-term contracts and what would be the typical renewal rates?

4. How does the industry compete? Is it based on price or based on a suite of services offered etc ?

5. The stock was listed in late 2017 and has given modest returns since then, what do you think is the reason for the same?

6. Which other domestic/international businesses do you think we should study to learn more about this space?

7. Any feedback on the quality of the management team?

Great read as always , do keep up the good work.