Shilpa Medicare - On the Verge of transformation?

Shilpa has historically been Onco focused API player, but with formulations, biologics and CDMO picking up. The next few years seems to be transformational.

Shilpa Medicare Limited, established in 1987 and headquartered in Raichur, Karnataka, is a prominent Indian pharmaceutical company specializing in the development and manufacture of active pharmaceutical ingredients (APIs), formulations, and biosimilars.

The company offers a diverse portfolio of over 400 formulations and 150 APIs, catering to both oncology and non-oncology therapeutic areas. With a strong focus on research and development, Shilpa Medicare has expanded its presence in regulated markets like the United States and Europe, providing contract development and manufacturing services (CDMO) globally.

Sales of biologics and formulation are expected to increase materially as a result of the expansion and introduction of limited competition products like Bortezomib RTU, Pemetrexed, imatinib, Nilotinib, Axitinib, Rotigotine, Tadalafil, and Sildenafil Citrate ODF in the EU and US markets, as well as the introduction of biosimilars & innovative molecules like Nor Ursodeoxycholic Acid, Aflibercept, and Adalimumab in the Indian and ROW markets.

Simultaneously increasing API capacity for both oncology and non-oncology therapies, as well as the growing traction & commercialization of CDMO (Unicycive contract) & recombinant human albumin (Orion tie-up).

There are a lot of risks include delays in the approval, commercialization, scale-up, and execution of generic oncology and non-oncology products across regulated markets, as well as failure or difficulties ramping up the recombinant human albumin segment, which is a key factor in the recent up-rating of multiple. Further pricing adjustments across the API segment may also have an impact on future profitability and earnings multiples.

• History of Shilpa Medicare

Year Event / Milestone

1987 Incorporated as Shilpa Antibiotics Pvt Ltd in Raichur, Karnataka.

1989 - Started commercial production of APIs.

1992 - Expanded API manufacturing capacity in Raichur.

2005 - Entered the oncology segment; started R&D for oncology APIs.

2007 - Began filing for regulated markets (US DMFs, EU CEPs).

2008 - Formed JV with ICE S.p.A. (Italy) for oncology API expansion.

2010 - Set up an oncology formulation facility at Jadcherla, Telangana.

2012 - USFDA approval for Jadcherla injectable unit.

2014 - Incorporated Shilpa Therapeutics Pvt Ltd – focused on oral thin film (ODF/ODS) technologies and novel drug delivery systems (NDDS).

2015 - Launched development programs in orodispersible and buccal films for CNS and ED therapy.

2016 - Commercialized SEZ formulation facility at Jadcherla for regulated markets.

2018 - Acquired stake in INM Technologies Pvt Ltd – R&D in nanotechnology, drug-device combinations (e.g., stents, IVDs).Formed Makindus Inc. (USA) – focused on ophthalmology pipeline.

2019 - Commissioned Biologics facility in Dharwad, Karnataka.Launched peptide R&D platform.

2020 - Subsidiary: Acquired controlling interest in Fermion Pharma Pvt Ltd for oncology intermediates. Launched Sildenafil ODS in India – first oral thin strip ED therapy.

2021 - Partnered with Dr. Reddy’s Labs for manufacturing Sputnik V vaccine.Launched Octreotide Acetate – peptide-based injectable.

2022 - Commercial production of Recombinant Human Albumin (rHSA) begun at Biologics unit.Strengthened EU and US injectable filings (ANDAs).

2023 - USFDA approvals for multiple ANDAs (oncology injectables).Clinical batches for biosimilars initiated (Trastuzumab, Adalimumab).Expanded Shilpa Biologics Pvt Ltd operations in Dharwad.

2024 - Filed for IV recombinant human albumin in India and EU.Clinical development for biosimilars (Rituximab, Bevacizumab).Scaling ODF products for CNS and cardiac markets globally.

• Manufacturing Plant Overview -

a) Raichur API Plants serve as the backbone of Shilpa’s API business, especially for oncology DMFs.

b) Jadcherla is the company’s hub for regulated market formulations (US & EU). Both non-SEZ and SEZ units handle injectables and orals.

c) Biologics (Dharwad) is emerging as a future growth engine — currently handling rHSA and biosimilars (with pilot-to-commercial scale-up plans underway).

d) ODF Facility (Shilpa Therapeutics) supports innovative thin film dosage forms and exports to developing/emerging markets, with regulated filings expanding.

e) Koanaa provides commercial access in the EU for oncology and specialty products (mostly under DCP/MRP filings).

• Overview of regulatory Action for it’s regulated market plants (USFDA & EMA) -

SEZ formulation plant in Jadcherla received a warning letter on October 9 along with 15 form 483 violations on account of significant CGMP violations, including inadequate investigations of out-of-specification (OOS) results and complaints, failure to implement effective corrective and preventive actions (CAPA), and inadequate written procedures for complaint handling.

• Segment Analysis

• Investment Thesis

1) Increase in Formulation export sales

Over the next 3 years formulation export sales are likely to grow materially from FY25 due to the implementation of large-scale, high-value launches, which would increase sales and profitability by improving the utilization levels of plant and other fixed costs across the board. Additionally, as they receive profit and revenue share from the items that their partners scale up and commercialize, their license revenue would also quadruple. The table below lists the molecules that will be growth drivers.

2) Development of Peptide API’s -

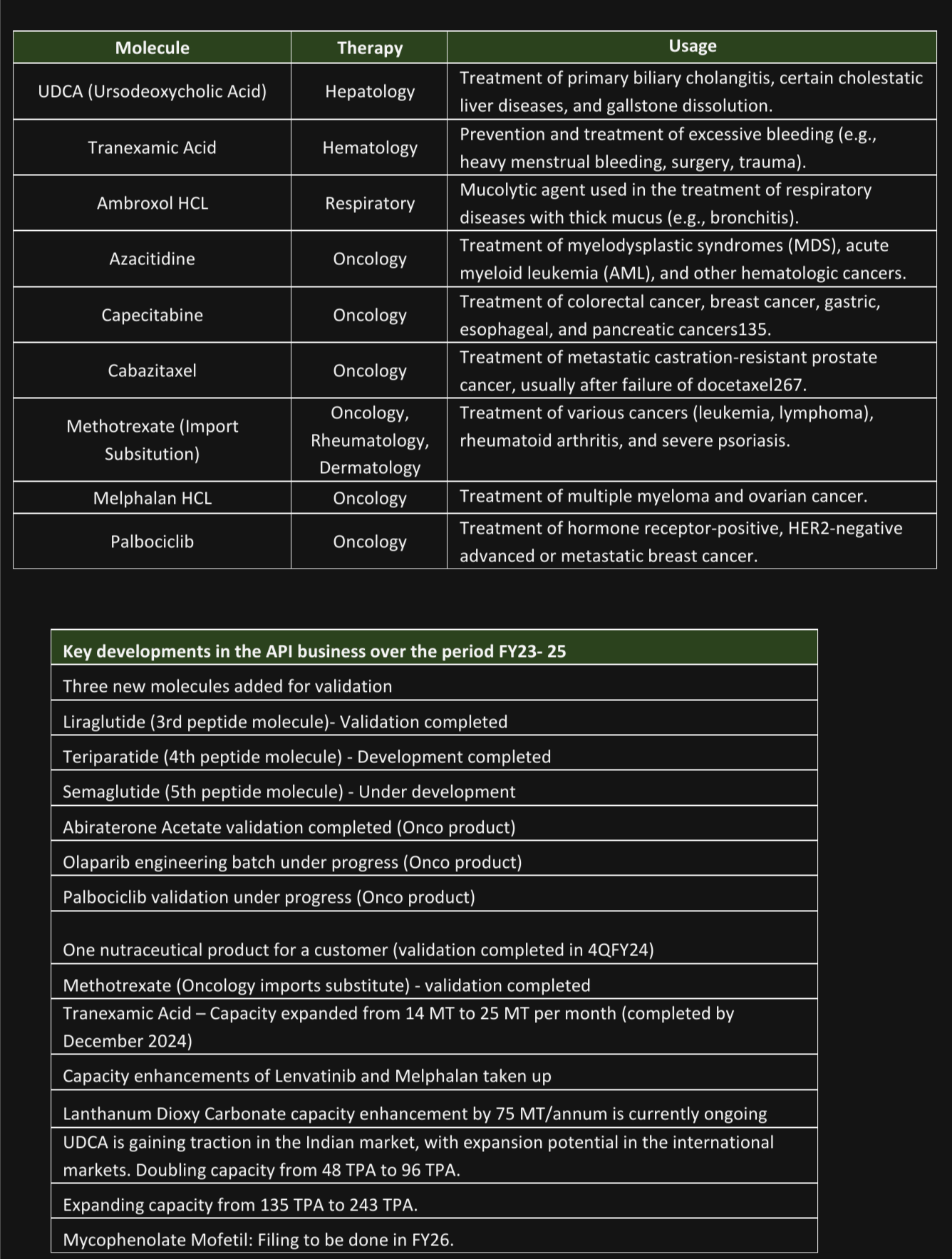

The development and commercialization of peptide products (Semaglutide, Teriparatide, Vasopressin Acetate, Plecanatide, Desmopressin Acetate, Octreotide Acetate, Liraglutide), import substitution (Methotrexate), and expansion of API capacity (UDCA, Tranexamic Acid, Ambroxol, Lenvatinib, Melphala) could all contribute to high growth across the API market.

3) Growth in Biosimiliars -

Biosimilars have large headroom for growth, & Shilpa is an early entrant in this space, with a sharp focus on early-mover advantage and differentiation, due to which we could see its biologics sales growing exponentially over the next three years.

Shilpa biological manufacturing facilities are equipped with advanced upstream and downstream processing capabilities for mammalian and microbial systems for MABs, fusion proteins, and adenoviral and adeno-associated virus-based gene therapies, and vaccine production. This includes mammalian cell culture capacities of up to 8,300 liters (with associated downstream processing), three filling lines, including a high-throughput line with capacities of 300 u/m liquid vial filling (for vaccines). These have been commissioned in fiscal 2021.

Besides the below mentioned products, Shilpa is also developing other high-value biosimilars such as Etanercept & Abatacept. Although Biosimilar for India and RoW remains highly competitive and cost intensive, Shilpa’s business model of out-licensing post development is a relatively risk free venture.

Adalimumab - Adalimumab is used for a range of autoimmune and inflammatory conditions, with dosing tailored to the specific disease, patient age, and weight. Shilpa has partnered with Sun Pharma in India & has already launched the product in India in Q4FY24. Also, biologics segment makes its sales from this single product. The current addressable for Adalimumab is 3.8 billion USD but for Shilpa TAM is likely to be in the range of 10-20 million USD.

Aflibercept - It is a drug used to treat wet age-related macular degeneration (AMD). It is also used to treat diabetic eye disease and other problems of the retina. It is injected into the eye to help slow vision loss from these and certain other diseases. The Indian market size for Aflibercept is $242.5 mn.

The product is to be launched in FY 27 with TAM of 5-10 million USD for Shilpa.

4) The positive outcome of the recombinant human albumin commercialization could turn into a "money spinner" for Shilpa in terms of cash flows and profitability, which would aid in altering the company's overall trajectory.

The pros and cons of recombinant human albumin over plasma-derived human albumin serum are thoroughly explained below to help you assess the potential for Shilpa rHSA.

Overview of the global Human Albumin segment (Recombinant vs plasma-derived)

Advantages of Recombinant over Plasma-Derived Albumin in Therapy

a) No human pathogen risk (e.g., HIV, HBV, HCV)

b) Animal-free and sustainable source

c) High batch consistency

d) Ethical advantage: No reliance on blood donors

e) Customizable: Modified albumin variants can be designed for specific drug interactions

Regulatory status of Recombinant over Plasma-Derived Albumin in Therapy

a) No rHSA product is currently approved for IV therapeutic use in humans (as of mid-2024).

b) Most approved rHSA products are used in biopharma manufacturing, not directly injected into patients

c) Clinical trials are ongoing in China and other regions to assess safety/efficacy for IV use.

The company is expected to initiate Phase 3 by Q4 FY25. The trials are expected to be completed in 9-12 months.

If a favourable outcome comes, this can result in the current plant generating anywhere from 200-450 crores depending on how the scale up progresses.

• Key Risks

1) Compliance Risk: A USFDA or any other regulatory authorities ban on even one of the facilities due to noncompliance could have a long-term negative impact on the company's financials and return ratios.

2) Lower than expected ramp-up in key products due to execution delay, delay in approvals, manufacturing issues, or others, i.e., Nilotinib, NorUDCA. Rotigotine, Adalimumab and Alopecia etc.

3) Significant price decline and hyper-competitive scenario in APIs could lead to depress earnings and profitability.

4) Failure of Phase 2/3 trials for rHSA, Alopecia, and other molecules.

5) In the event that Unicycive is unable to get the required US FDA approval, CDMO earnings would be materially affected. Also, unicycive is unable to gain meaningful market share given existing generics and plenty of other options available.

Disclosure - We are not registered under SEBI. All information above is based on public sources and due diligence conducted by us. We may or may not have invested in stocks which we have written about.

We run a free substack and post one article a week on Indian Equities. If you like our posts, kindly consider subscribing and sharing our posts / publications.

For other Pharma & Chemical companies refer to -

Disman Carbogen Amics - https://substack.com/home/post/p-165452288

Suven LifeSciences - https://cashcows.substack.com/p/suven-lifesciences-indias-entry-into

Styrenix - https://cashcows.substack.com/p/styrenix-legos-thermocol-and-import

Indoco Remedies - https://cashcows.substack.com/p/indoco-remedies-cheapest-domestic

Kiri Industries - https://cashcows.substack.com/p/kiri-industries-where-cash-market

Vishnu Chemicals - https://cashcows.substack.com/p/vishnu-chemicals

Panacea Biotech - A global vaccine powerhouse in making - https://substack.com/@cashcows/p-158207990

For Industry reports - Kindly refer to

Automobile Primers -

2 Wheelers - https://cashcows.substack.com/p/all-you-need-to-know-1-automobile

4 Wheelers - https://cashcows.substack.com/p/all-you-need-to-know-2-automobile

CV - https://cashcows.substack.com/p/all-you-need-to-know-2-automobile-686

Tractors and Others - https://cashcows.substack.com/p/all-you-need-to-know-44-agri-and

Logistics Primer -

https://cashcows.substack.com/p/all-you-need-to-know-logistics-sector