#1 - SastaSundar Ventures - Undiscovered microcap in the E-Pharma space.

A micro-cap company in the E-pharmacy and E-diagnostics company

The E-pharmacy space has sprung to life with multiple large deals in the recent past.

Pharmeasy acquired Medlife in a share-swap deal with Medlife acquiring 19.59 percent in API Holdings. Pharmeasy raised 350 million USD valuing the company at 1.5 billion USD and is looking to IPO at a valuation of close to over 3 billion USD( 22000 crores) in the upcoming year by raising 3000-3700 crores.

Mukesh Ambani backed Reliance Retails acquiring a majority stake in NetMeds for a consideration of 620 crore for a 60 percent stake valuing the company at a little over 1000 crores.

Tata Digital also acquired a majority stake in 1MG and had earlier in April had invested 13 million at a valuation of around 240 million USD (1700 crores)

Amazon has also forayed into this space by Amazon Pharmacy.

Pharmacy chain Medplus backed by Warburg Pincus has hired bankers to raise close to over 2000 crores at a valuation of 7200 crores.

With 2 big companies coming up with public issues in a year’s time and large acquisitions by players with deep pockets, the future in E-pharmacy looks promising.

Together, the Indian health tech market is expected to contribute $21 Billion by 2025 from the current $1.2 Billion, which is still only 3.3% of the total addressable healthcare market.

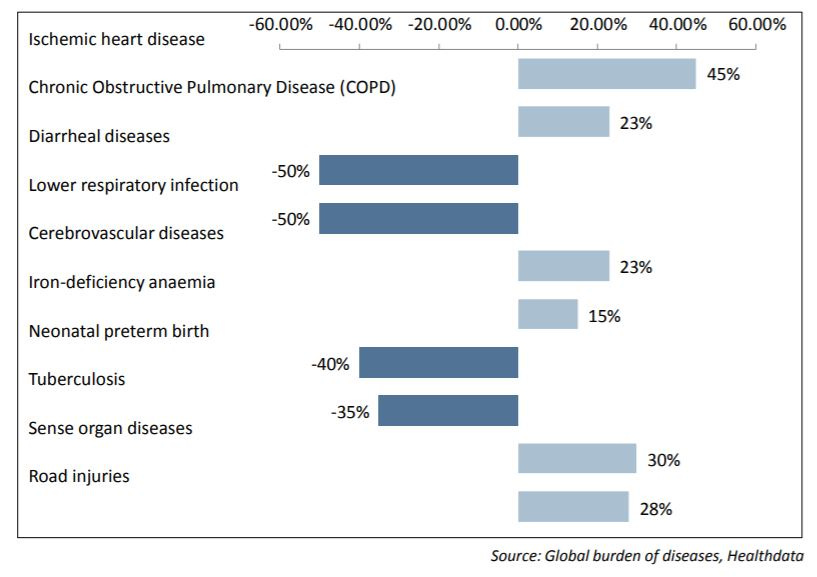

Majority of the customers for e-pharmacies are for chronic diseases which require regular repeat orders. Below is the list of top 10 diseases which causes highest mortality and morbidity in India.

Amongst all the e-pharma players there is already one player in the listed e-pharmacy space. SastaSundar Ventures is a core-investment company with it's subsidiary SastaSundar Healthbuddy Limited another big player in the E-pharmacy space backed by Mitsubishi Corporation and Rohto Pharmaceutical

Sastasundar ventures - the listed company owns 72 percent of Sastasundar HealthBuddy.

Sastasundar Digital Network is being built upon Online to Offline model of healthcare delivery leveraging technology and inventory less service center of franchise called Healthbuddy.

The valuation as per last round close to 2 years ago was at 110 million USD ( 800 crores). The last valuation round was done at close to 2x Sales.

The company is looking to raise 100 million USD which will take the company on a national level. Currently the major footprint of Sastasundar ventures is in Kolkata and Delhi-NCR Area. The management believes the 100 million fund raising across 2 years will be sufficient for the company to go nationwide.

Strengths for SastaSundar Ventures -

Faster Adoption and exponential growth due to covid -

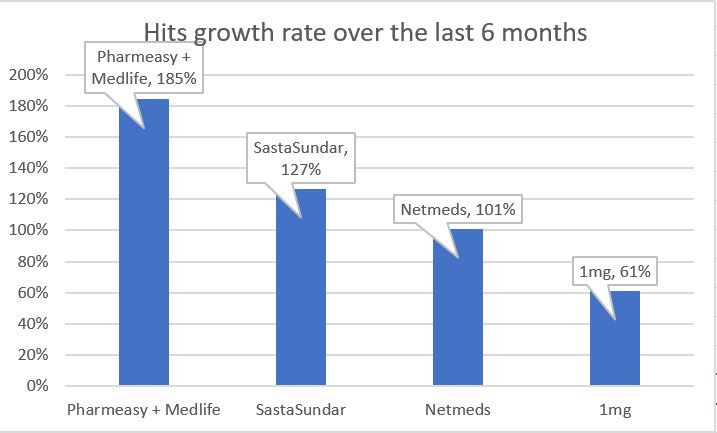

One can see a substantial growth over the adoption for E-pharmacies over the last 6 months from the website hits across major E-pharmacies. Almost all companies have doubled their website hits over the last 6 months, with the 1st and second wave of covid being key catalyst in the E-pharmacy space. One can see that SastaSundar has benefited heavily with the hits more than doubling across the last 6 months.

Growth in e-diagnostics space -

SastaSundar Healthbuddy Limited has forayed into e-diagnostics space via Genu Paths Labs and the same is growing as planned. Health data from medicine sales integrated with the lab’s data has tremendous potential and personalized health-tech is the future of healthcare. The company had 1.2 lakhs tests in 2020.

Conservative Management -

The problem with investing in a startup/ PE type of company is the high cash burn it entails and the possibility of never reaching profitability. Compared to other peers, SastaSundar has done incredibly well to avoid a lot of cash burn. The company has substantially reduce loss from 30 crores for 9 month FY 20 to around 5 crores for 9 month FY 21. The company is trading almost at breakeven with -1/-2 percent margins which is commendable in an industry where the margins for other bigger companies are at anywhere from -25% to -89%.

The management in its annual report in 2019 had given a guidance of growth of 5 million orders in FY 19-20. The same was fulfilled in 11 months. The managements in its annual report in 2020 has given a guidance of growth of over 10 million order in FY 2020-21, whether the same has been fulfilled will be analyzed whenever the records are released.

Strong growth backed by Japanese MNC’s - The company has compounded sales growth by 49 percent CAGR over the past 5 years and almost 42 percent over the past 3 years. The company is in further talks to raise money to go national which shows despite the tough competition in the E-pharmacy space, the company also has investors with deep pockets and the offline to online model can be a significant disruptor in the healthcare space.

Weaknesses for SastaSundar Ventures -

Strong competition -

The e-pharmacy space has brutal competition with players with very deep pockets as mentioned earlier which can result in a 2-3 player consolidation style model like Cab Aggregators (Ola and Uber), Food delivery(Zomato and Swiggy) and online B2C marketplace(Amazon, Flipkart).

Low Float/ Illiquid stock - The company has only around 200 crores worth of free float, which makes entry/exit of any large player extremely difficult and not without some sharp increase and decrease.

Business Model change - The company was earlier a Financial service entity and had tried to venture into digital marketing, brand promotion, food processing and than pivoted into e-pharmacy which is not a very common route. Though it doesn’t impact what the company is doing currently, it still a minor sign of concern.

Holding company discount - If we take a prospective valuation of 2x sales, the underlying company should be valued at around 1100 crores. In India, where the holding company discount is much sharper even for larger companies like Bajaj Holdings, that could be a case of concern if the company fails to deliver in the growth area.

Conclusion/ Disclosure - I see tremendous potential in e-pharmacy space and SastaSundar Ventures is currently the only way to the play. I am invested in SastaSundar Ventures owing to good fundamentals in the business model, strong tailwinds and reasonable comparative valuations.

Market Cap at the time of writing the article - 767 crores