#6 - Elgi Equipments - Global Air Compression player

Indian company with R&D capabilities looking to disrupt the global air compression markets

Elgi Equipment is a player in compressed air technology with presence across more than 120 countries. The company has a product portfolio of 400+ compressed air systems and has 2+ million installations all over the world.

With a market share of around 22%, EEL is one of the largest manufacturers of compressors in India. However, Elgi is more of a global player, with almost 50% of revenue coming from outside India.

Major competitors for air-compressors in the space are

Atlas Copco - The largest player in the air-compressor space.

Ingersoll Rand - Ingersoll Rand is the second largest player in the air-compressor industry. It has its subsidiary Ingersoll Rand (India) which is listed in the Indian Markets.

Kirloskar Pneumatic Company Limited

Understanding the air compressor Industry

Air-Compressor Industry -

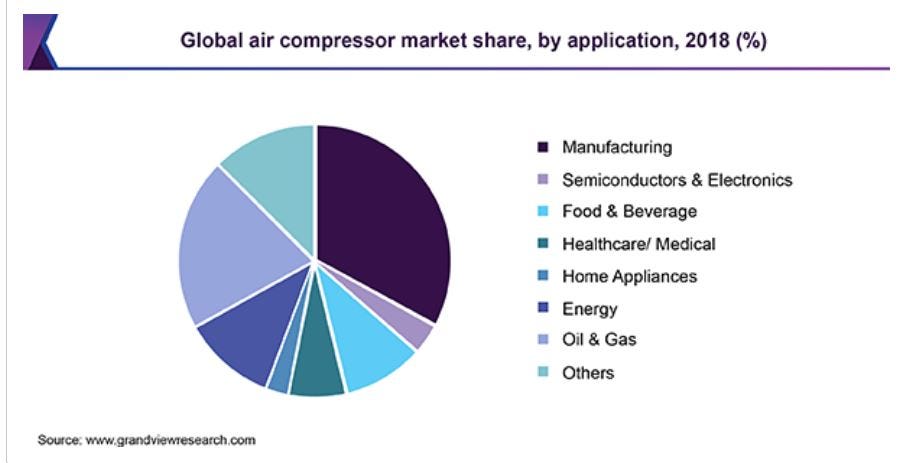

Air compression is used in a wide spectrum of applications in nearly all manufacturing and industrial facilities and many service and process industries in a variety of end-markets, including infrastructure, construction, transportation, food and beverage packaging, chemical processing.

In industrial processes, air is needed in Oil and Gas, Energy, pharmaceutical, electronics, Semi-conductors and Textile industries.

Compressed air is also used to power industrial tools, in robots, and in applications as diversified as hospitals, snow making, fish farming, high-speed trains, wastewater treatment and conveying.

Below is the global compressor market share by end uses.

Market size -

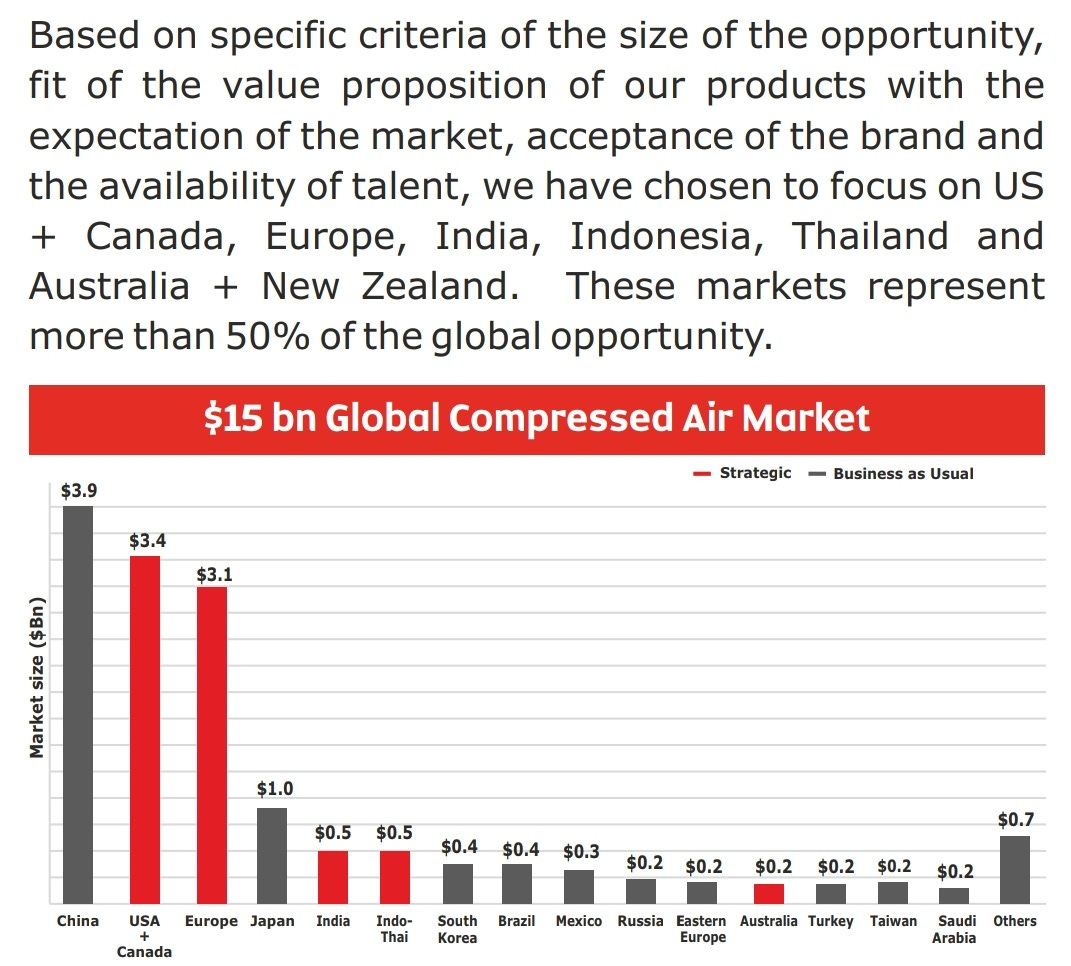

The market size of air compressor industry is 15 billion USD. The Indian market size comparatively is only a little over 3 percent of the total global pie. The global market is expected to grow at 3% CAGR and the Indian Market is expected to grow at 7% CAGR in the next 5 years. This along with possibility of gaining market share overseas and entering newer markets makes Elgi a very interesting player.

The nature of air-compressor industry is that it is diversified revenue source without a dependence on any specific industry vertical. Two, the geographical opportunity reduces the risk of dependence on any one economy and its business cycle for Elgi.

Elgi's primary focus is on North America, Australia, South East Asia and Europe which is 50% of the global opportunity. Below are the large markets in air-compressor industry.

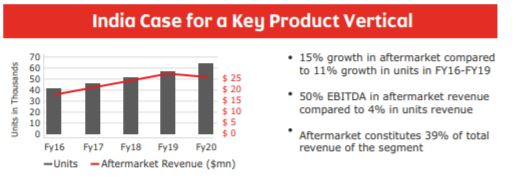

Aftermarket/ Recurring revenue - The biggest positive for the industry is the aftermarket revenue it generates. For every dollar of equipment sold, aftermarket generates 1.2 USD across the next 10 years in aftermarket sales. In addition to the same, the aftermarket parts gross margins are almost 2-3x of the original equipment. Recurring revenue is anywhere from 30-50 percent of total revenue.

The aftermarket growth is outpacing the growth in units in India due to a higher installed base. As the installed base increases in India and in other countries, the certainty of recurring revenue is almost given.

The nature of the industry thus is a factor of

New Installations.

After Market revenue from the installed base.

Indigenous Technology, Focus on quality and R&D -

Elgi Equipments has built its own indigenous technology for compressors which competes and fares strongly against the deep pockets of multi-national brands.

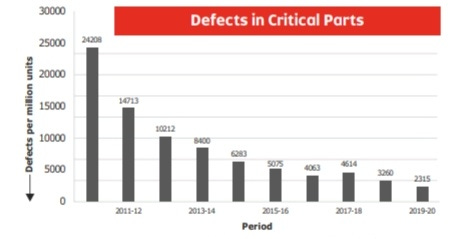

Below shows the increasing focus on quality by Elgi.

In addition to the same, the company offers the longest warranty of any company in the world and at the cheapest price.

The focus on quality and indigenous technology has helped Elgi build a strong brand in India and overseas.

Elgi is a global brand and the company has R&D capabilities to innovate in order to stay relevant. The R&D capabilities can be seen by technology relating to oil-free compressors Currently, oil-lubricated compressors and oil-free compressors exist as two separate categories. Both in terms of product offerings and end-use applications. Oil-lubricated compressors are more efficient and less expensive than oil-free compressors. However, in applications that cannot tolerate oil in the air, customers do not have a choice but to buy oil-free compressors, and they pay the penalty of a high upfront price as well as higher running cost. Elgi has managed to develop a technology that converges these two categories so that all compressors are oil-free with low upfront cost and comparable running cost.

Global player -

The company is also aggressive in its growth plans in-organically. The company has acquired 8 air compressor production and distribution companies around the world in the past decade, entering the markets

Below is the revenue mix from different geographically (FY 21) -

India - 52%

Americas - 24%

Europe - 9%

Australia - 7.5%

Others - 7.5%

Potential weaknesses

Competitive intensity -

While capital cost for setting up a compressor manufacturing unit is not high due to the assembly nature of operations, technology plays a major role and acts as an entry barrier. Most large domestic players are subsidiaries of established international companies or have technical collaborations with global players which makes the air-compression industry tougher to thrive.

The merger between Ingersoll Rand and Garden Denver, the second and the third largest air-compressor companies, have created a very strong number 2 air-compressor industry further consolidating the space.

Poor performing subsidiaries in the past -

The company’s acquisitions were not without their issues. The company had foreign currency debt issues in Brazil and legal issues with their French subsidiary along with other issues which resulted in continuous losses in the last downcycle in 2015.

While the company has addressed the same by restructuring of operations in China, converting most of foreign currency debt into local currency in Brazil, and admitting the French subsidiary, SAS Belair, to legal redress which has helped curb losses.

While most of the above units are likely to be profitable over the medium term, their revenue contribution are still modest compared to the company, as stated above.

Modest performance - The company despite a lot of promises has not performed very well over the last decade or so, where the revenue and profit growth has been in low single digits. That can be partly attributed to the company diversifying in 2013 to other geographies.

The company seems to have reached an inflection point with the foreign subsidiaries growing very well in the pandemic induced year. With growth possibly being back in India and South-East Asia over the next year or so, the company looks prime

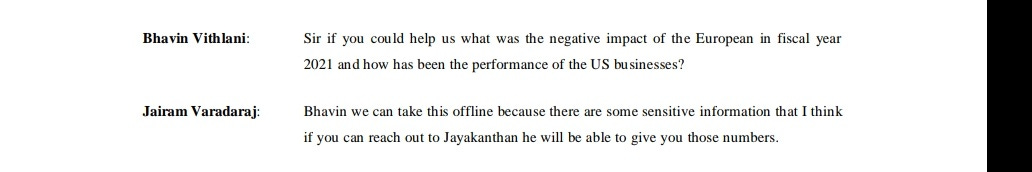

Alternate sources of information/ Red Flag ? - Going through the concall, I came up with a seemingly orange/red flag.

Below is the conversation with the management and an analyst from SBI Mutual Fund who is the largest DII shareholder with an almost 8% stake in the company. SBI small cap (one of the largest small cap funds) also has their largest allocation to Elgi equipment.

The company citing sensitive information has asked the analyst to reach out to a member of the company for information.

As a retail investor, I am not sure if I would have access to the information, which should be a big red flag in my books. I have dropped an email for the same to the company and am awaiting a response.

If any retail investor can get the information than nothing stops the competitors from getting the above so called *confidential* information

And if a retail investor cannot get the information that means there are 2 channels of communication, one with institutional investors and one with retail investors which questions the integrity of management.

I would be waiting a couple of weeks for the response before shadowing doubts over the management but it is still an orange flag.

Conclusion - The company has set broader targets for FY 2025-26

1. Revenue - $ 400Mn

2.EBITDA - 16%

3. ROCE - 30%

Let us assume the same, on the same assumption, the company can be expected to see profit in the range of Rs. 240 crores in FY 2015-16 at a CAGR of around 15%.

That should be valuing the company at around 29x FY 2025 numbers.

The company looks to disrupt the global air compressor industry and while it has some potential for the same, the valuations along with the above orange/red flag scenario makes it a no go for me.

For any collaborations/ideas/other matters drop an email to cashcowsindia@gmail.com

Follow me on twitter, I have more subscribers on Substack than on Twitter, trying to change it, please consider following the account if possible - https://twitter.com/CashCowsIn

Check out the other companies I have written below -

1 SastaSundar Ventures - A micro-cap in the E-pharmacy space -

2 Godrej Agrovet - An all inclusive bet on Indian Agriculture

3 Finolex Industries - A strong player in the Plastic pipes industry

4 IndiaMart InterMesh - Largest B2B classifieds player in India

5 Bajaj Holdings

https://cashcows.substack.com/p/5-bajaj-holdings-and-investment-limited?r=n0hml&utm_campaign=post&utm_medium=email&utm_source=copySector Coverage -