All you need to know (#4/4) - Agri and Construction Equipment

Your one stop shop to understanding the automobile sector in India

All you need to know is a series deep-diving on sectors and themes -

The first part of the series focuses on Automobile OEM’s, the tailwinds, the disruptions and how and where are the listed companies placed

Let’s start with the basics -

OEM’s can be broadly classified into sub-segments i.e. -

2W – Scooters / Mopeds / Bikes

4W – Small (Hatchback and Sedans) and Large Cars (SUV’s and Van’s)

3W – Goods and Passengers Rickshaws

Commercial Vehicles (CV’s) – Tempo’s, Trucks, Buses etc. (LCV / MHCV )

Agri-Equipment – Tractors, Tillers etc.

Construction Equipment – Cranes , Backhoe loaders, Excavators etc.

In the first part we focused on 2 Wheelers - OEM 2 wheelers

In the second part we focused on 4 Wheelers - OEM 4 Wheelers

The third part focuses on CV and 3 Wheelers - OEM - CV and 3 Wheelers

The final part focuses on Agri and Construction Equipment -

Agri equipment -

Tractors are the largest sub-segment for Agri-Equipment followed by Tillers.

Tractors volumes have grown at ~2-3% CAGR over the last 10 years.

Market mapping and share -

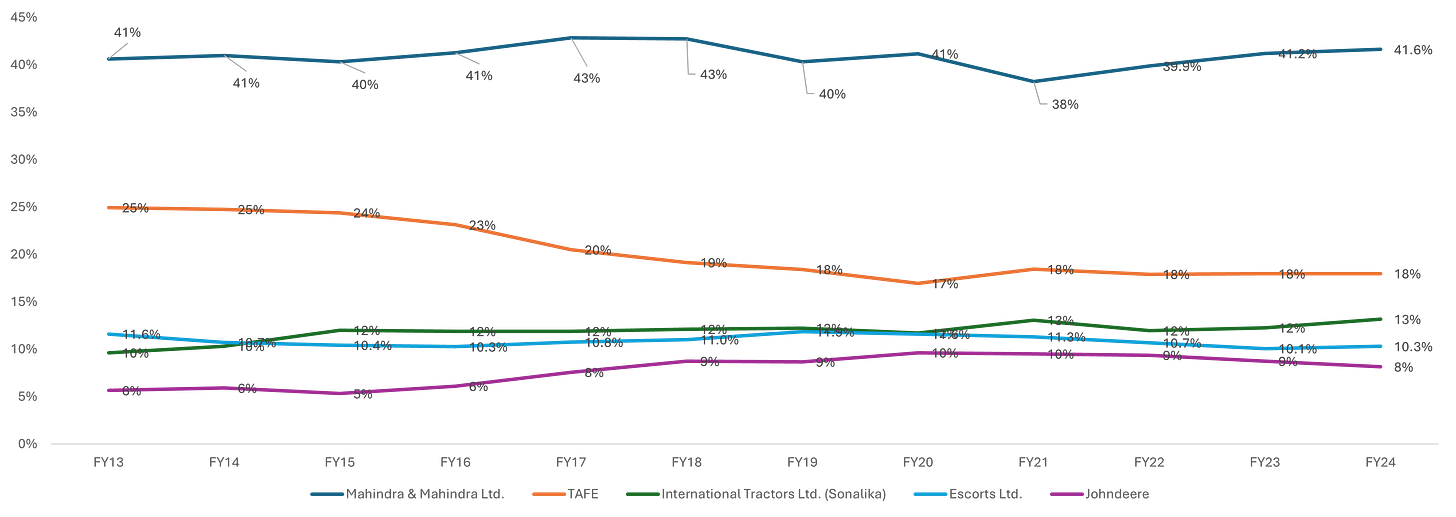

Mahindra is the largest tractor manufacturer in the country, followed by TAFE, International Tractors and Escorts Kubota.

There are 3 sizable OEM’s catering to agri market

Mahindra continues to hold onto ~41-42% MS and in FY25 has grown faster than market.

Escorts Kubota is the other listed player where MS is ~10-11%.

VST Tillers and Tractors is primarily into Tillers and has grown in-line with Industry over the past few years.

How has Tractors and Tillers performed in FY25 -

Tractors grown has been flattish for YTD FY25, however Mahindra and Escorts have outgrown the market, while VST has under-performed the market.

Conclusion - Broadly Agri-equipment is linked to farm income, strong monsoons and solid rural recovery. While monsoons have been decent in 2025 and rural continue to do better than urban, Farm Equipment can do well in next 2-3 years.

Construction Equipment -

There is only pure-play construction equipment player listed in India.

Action Construction Equipment (ACE)

ACE is a construction-based OEM focuses primarily on cranes, with presence in construction, material handling and agri equipment.

It has ~63% market share in pick and ~60% carry crane and tower crane. Cranes in 73% of revenues.

It faces competition in P&C from Kubota and in Tower crane from Potain India .

End-user split is Manufacturing ~45% / Infra ~35%, Real Estate ~10% and Agriculture ~10%

Conclusion - Broadly, construction equipment companies do well in strong capex and infra cycle. With BSV norms applicable from 1st January, inventory filling was seen in Q2 and Q3, which will normalize in Q4 and Q1 FY26.

Thank you and very good primer to understand Indian automobile market scenario. Looking forward for auto ancillaries as well.

Good summary 👌